The Lithium Triangle in South America is home to about 58% of the world’s identified lithium resources. The area covers parts of Argentina, Chile, and Bolivia. Chile is the second leading global producer of lithium, currently providing about 26% of the world’s supply, while Argentina checks in as the fourth leading producer at 6%. Bolivia sits on the largest reserves in the world, but the industry hasn’t taken hold there due to a wide variety of reasons, ranging from political to environmental to economic. Meanwhile, the government of Chile recently announced it would be taking over the lithium industry there. Nobody really knows how the new policy will work out in the long term, and the policy has not yet resulted in the creation of the National Lithium Corporation, but the immediate effect may be a decrease in private investment in new lithium production in the country while the new system takes shape.

Argentina, however, is charging full speed ahead with lithium production, and the national government is encouraging development of new sources and projects. There are two currently-producing mines in Argentina, and at least 10 projects in relatively advanced stages of development. If investors are looking for emergent lithium opportunities, Argentina is a prime place to start the search.

Let us introduce you to a little-known, under appreciated lithium project. It is one of the last publicly traded junior miners on the world-renowned Hombre Meurto salar in Argentina. Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF) is progressing its Hombre Muerto North Lithium Project (HMN Li Project) toward production and recently announced a 175% increase in resource expansion. The HMN Li Project is surrounded by two major lithium operators; POSCO (Korea) with a US$4 billion lithium development at the north and Livent Corporation, in operation for over twenty-five years, in an area just south. With the right location, one of the highest grades in the world, a favorable Mg/Li ratio (high purity), and a number of NDAs with big industry players in discussions with the company, this lithium project delivers on value.

Hombre Muerto North Li Project Status

In 2018, Lithium South (at the time called NRG Metals) commissioned an NI 43-101 Technical Report on its Tramo claim block, comprising 3.6 square kilometers (about 14%) of a much larger block of wholly owned claims the company holds throughout the Salar del Hombre Muerto. The report showed a resource estimate of 571,000 tonnes of measured and indicated lithium carbonate equivalent (LCE). In 2019, the company completed a Preliminary Economic Assessment (PEA) based on the known resource at the time. The PEA showed profitability over a 30-year mine life, assuming production capacity of 5,000 tonnes of lithium carbonate annually.

Lithium South then expanded its drill program to two other blocks in the area, the Natalia Maria and Alba Sabrina blocks. The company announced completion of the drill program in March 2023. Lithium South recently released an updated NI 43-101 Technical Report that included the results. Highlights of the report include:

- 1,583,200 tonne LCE Resource

- 175% increase in LCE over previous Technical Report

- Average lithium grade of 736 mg/L (High concentration of Li)

- Magnesium/Lithium ratio of 3.27/1 (Low concentration of Mg contaminant)

- 90% of the Resource is Measured, the highest resource classification

- 18% of Lithium South’s salar-located claims yet to be explored

Lithium South has hired two companies to complete a new Preliminary Economic Assessment (PEA) that will utilize information from the updated Technical Report. Just as the underlying resource nearly tripled with the expanded exploration, the company anticipates the PEA will contemplate a baseline production capacity of 15,000 tonnes/year, triple the rate of production outlined in the previous assessment.

Lithium South has also hired Peter Ehren to improve the efficiency of its lithium brine evaporation operations. With the processes implemented by Mr. Ehren, the new PEA for a lithium mine will be based on lithium recovery rates of around 70%, as compared to the 50% figure used in the previous study.

HMN Li Project Evaporation Ponds

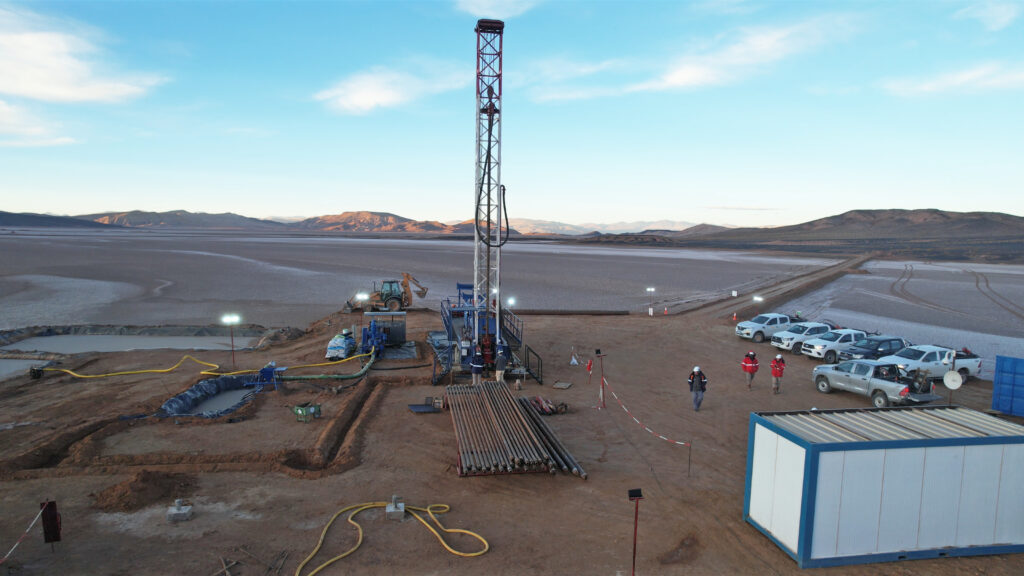

Most recently, Lithium South completed installation of its first production well on its claims. The well will be tested for production capacity, maximum flow, and brine transmissivity, providing information critical to the PEA. This is the first of several such wells throughout the HMN Li Project. The company is also drilling on a nearby claim block to provide water, a crucial reagent in the production of lithium carbonate.

HMN Li Project First Production Well

Active Lithium Market

Lithium South is moving its HMN Li Project steadily toward licensing and production. Announcements of progress have been regular over the past year, and the company is transitioning from being a lithium explorer to becoming a lithium developer. But at any time, an acquisition could occur if a major corporation became interested in the project. The acquiring company could be a major miner, or a multinational steel company, or even a car manufacturer looking to secure lithium supply.

In the past 5 years, three acquisitions have taken place in Lithium South’s corner of Argentina. These buyouts serve as a barometer of the potential value of Lithium South’s claims.

Lithium South properties border directly on POSCO Holdings property, and POSCO is investing $4 billion into a lithium processing and commercialization factory there with the intent of becoming the world’s third largest battery-grade lithium producer in the world by 2030. It’s a nice neighbor to have, and the investment certainly highlights the value of lithium production in the area. POSCO, a South Korean steelmaker, bought the mining claims surrounding LIS in 2018 for $280 million. The deal was based on 1.58 million tonnes of measured and indicated LCE resources, with another 0.96 million tonnes inferred. So, including the inferred lithium resource, you’ve got $280 million for 2.54 million tonnes LCE, or about $110 million per million tonnes LCE.

Also in 2018, Chinese resource investment firm NextView New Energy bought Lithium X and its Argentinian claims for C$265 million, or about $200 million in US dollars. The deal was based around the Sal de los Angeles project and its 1.636 million tonnes of measured and indicated LCE resources, with another 412,100 tonnes of inferred resources. Including the inferred lithium resource, NextView bought about 2.05 million tonnes of LCE for $200 million, or about $100 million per million tonnes LCE.

In early 2022, Lithium Americas Corp. acquired Millennial Lithium and its Pastos Grandes brine project for about $400 million. A few months earlier, Millennial had been entertaining an offer from battery producer CATL for about $300 million. The Pastos Grande project has 4.12 million tonnes of measured and indicated LCE resources, along with another 798,000 tonnes of inferred LCE resources. Including the inferred resources, Lithium Americas bought about 4.9 million tonnes of LCE for $400 million, or about $82 million per million tons LCE.

The Upshot

When looking at the referenced deals, it’s important to note that all of the 1.58 million tonnes of LCE from Lithium South’s project is measured and indicated, with none inferred. So, the numbers might not be exactly apples to apples, but they are close and would generally favor Lithium South in a discussion of the potential value of the resource for acquisition.

Realizing that every project is different, it’s reasonable to use an approximate value of $100 million per million tons of LCE for lithium brine operations in Argentina. By that metric, a sale of the HMN Li project and its 1.58 million tonnes of measured and indicated LCE could net in the neighborhood of $158 million. Lithium South’s current market capitalization is around $22 million.

Disclaimer: TDM Financial is paid a fee of $ U.S. 7,000 per month by Lithium South Development Corp (LIS) for advertising consultation. TDM Financial produced this advertisement on behalf of LIS and as such it should be considered advertising. Nothing written in this advertisement is meant to facilitate a trade in the shares of LIS, and is not to be considered investment advice. This advertisement is published for information purposes only and the reader is encouraged to do his/her own due diligence regarding LIS.

This advertisement contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward-looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

Mr. William Feyerabend, a Consulting Geologist and Qualified Person under National Instrument 43-101, participated in the production of this advertisement and approves of the technical and scientific disclosure contained herein.