Graphite One Positioned for Looming Graphite Supply Crunch with Strong 2022 Completed Objectives

VANCOUVER, BC, Dec. 30, 2022 /PRNewswire/ – Graphite One Inc. (TSXV: GPH) (OTCQX: GPHOF) (“Graphite One”, the “Company”, or “G1”) is pleased to provide the Company’s 2022 year in review and provide objectives for 2023.

2022 Highlights

- 2022 Pre-Feasibility Study

- Total capital raised of CA$15.1 million and settled an outstanding debt of CA$8.8 million (US$6.8 milion) by completing a shares for debt transaction

- President Biden Declares Graphite as 1 of 5 Battery Materials “Essential for National Defense”

- U.S. Defense Appropriations Bill Includes Funding for Graphite Rechargeable Battery Applications & Natural Graphite Foam Fire Suppressant

- U.S. Geological Survey Cites the Company’s Graphite Creek Resource as Largest Known U.S. Deposit

- Washington State Selected as Site for the Proposed 2nd and 3rd Links in Graphite One’s Complete U.S.-Based Supply Chain

- Completed a 2,090 meters drilling program to expand resources to be included in the Feasibility Study

- Battery anode active materials now being produced as samples for EV manufacturers using the Company’s graphite concentrate from Alaska.

“With the support of our shareholders, local community and management, Graphite One had a tremendous year in 2022, progressing the largest known graphite deposit in the United States one step closer to producion,” said Anthony Huston, Graphite One CEO. “We delivered a highly robust inaugural PFS, completed the 2022 drilling program in support of our Feasibility Study, raised more than CA$15 million in capital, completed a shares for debt transaction to settle an outstanding debt of US$6.8 million, and advanced our plans to secure our graphite manufacturing facility in Washington State. Additionally, the U.S. Government recognized Graphite Creek as the nation’s largest known graphite deposit, instituted a new federal tax credit for domestic battery material production, and declared graphite an essential U.S. Defense Production Act material. It’s a testament to our strategic plans, and we have the resource and the team that can quickly develop a domestic supply chain to meet the United States’ need for battery anode materials for many years into the future.”

As Graphite One moves forward with its Feasibility Study (“FS”), the Company reported progress in 2022 along the following fronts:

2022 Financing

From January 1, 2022 to date, total gross proceeds raised from equity financings plus the exercise of options and warrants[1] exceeded CA$15.1 million[2]. The Company also settled an outstanding debt of US$6.8 million through a shares for debt transaction by issuing 9,296,328 common shares at a deemed price of CA$0.90 per share. “Our 2022 financing is a strong signal that capital markets are recognizing the Graphite One Project as the largest natural graphite deposit in the United States, with very robust economics presented by the inaugural PFS,” said Mr. Huston.

Graphite One Prepares Sample Battery Material for EV Manufacturers’ Analysis

As 2022 draws to a close, Graphite One’s Alaska graphite concentrate is being used to prepare sample battery anode materials for two major Electric Vehicle (EV) manufacturers, while an artificial graphite anode sample is being prepared for a third EV company. Results are expected in the first of quarter of 2023.

Completion of Graphite One Pre-Feasibility Study (PFS)

Graphite One completed the PFS for its U.S.-Based Graphite Supply Chain Solution, demonstrating a Pre-tax US$1.9 billion NPV (8%), 26.0% IRR and a 4.6 years payback. The post-tax basis, US$1.4 billion NPV (8%), 22.3% IRR and 5.1 Years Payback on its Integrated Project. The PFS, prepared by JDS Energy & Mining Inc. with assistance from various independent technical consultants, is available on our website: https://www.graphiteoneinc.com/pfs/.

On average, Graphite One would produce about 75,000 tonnes per year of products. About 49,600 tpy would be anode materials, 7,400 tpy purified graphite products, and 18,000 tpy of unpurified graphite products.

With the August 2022 passage of the U.S. Inflation Reduction Act (the “Act”) – for which U.S. federal tax guidance will be issued in March 2023 – domestic content tax credits are available which could benefit Graphite One. The Company expects to issue projections of the new federal tax credit impact once the guidance is published.

The Act instituted, among other things [3]:

- A tax credit to producers in the U.S. of anode materials equal to 10 percent of the costs incurred with respect to the production of anode materials commencing December 31, 2022 and reducing to 75%, 50%, 25%, and 0% in 2030, 2031, 2032 and thereafter, respectively.

- A tax credit equal to 10 percent of the costs incurred with respect to production of graphite purified to a minimum purity of 99.9 percent graphitic carbon by mass (“Purified Graphite“) – the phase out provisions in 1 specifically do not apply.

- Only production in the United States qualifies for the tax credit.

Graphite One’s production is expected to qualify under the Act for tax credits in both categories as it plans to produce both anode materials and Purified Graphite in the United States, as defined in the Act.

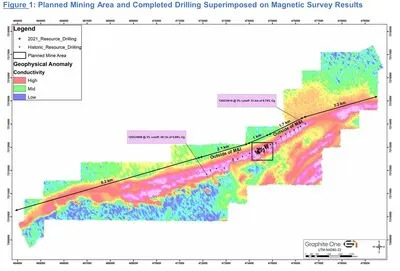

While the geophysical expression on the Graphite Creek property spans more than 16 km, the PFS was based on an assessment of about 1 square km — or less than 7% of the anomaly. Drill results to date indicate the resource remains open down dip and along strike to the East and West.

Given rapidly rising graphite demand, G1’s Feasibility Study is expected to focus on expanding annual production significantly from the 50,000 tonne projection in the PFS.

Graphite elevated into select group of “Critical Minerals” after receiving DPA Title III designation

Graphite and other battery minerals – lithium, manganese, cobalt and nickel – join rare earth materials as the only U.S. Government-listed Critical Minerals eligible for the comprehensive support provided by the Defense Production Act (“DPA”). Unlike Presidential Executive Orders, designations under the DPA, first passed during the Korean War, carry the full force of U.S. federal law.

“With this new defense designation under U.S. law, graphite joins a select group of ‘super-critical minerals’ that are essential to commercial technology and national security applications,” said Anthony Huston, CEO of Graphite One. “This action by President Biden validates Graphite One’s strategy of creating a full supply chain for advanced graphite materials located in the United States.”

2023 Defense Appropriations Bill

The annual Defense Appropriations Bill, passed December 15, 2022, includes funding for graphite as a rechargeable battery material, as well as natural graphite-based foam fire suppressant.

While Graphite One’s PFS suggests that 66% of Graphite One’s products are for the support of the EV and lithium ion battery sectors including energy storage systems in the form of battery-anode active materials including Coated Spherical Graphite, 2022 saw continued progress in materials development for evolving markets for advanced graphite material.

“With the World Bank and International Energy Agency (IEA) projecting graphite demand to rise by 25 times between 2020 and 2040 (IEA) or more than 490% from 2020 to 2050 (World Bank[4]) — and new efforts to simultaneously build out energy storage systems underway, multiple uses of the same renewable battery technologies are beginning to compete for the same material supply,” Mr. Huston noted. “As a result, global graphite shortfalls initially projected for 2024 or 2025 are now predicted to begin now, as we reach the end of 2022.”

Graphite Foam Fire Suppressant:

Test Work at the U.S. Naval Air Warfare Center

While Graphite One’s primary focus remains the production of lithium-ion battery anode materials, the Company’s foam fire suppressant work is a prime example of the advanced graphite material opportunities in markets outside of the renewable energy sector. The newly-passed Defense Appropriations bill indicates the importance of this application for emergency response, safety and environmental impacts.

Graphite One is well positioned for this high-priority defense application. In 2022, test work was completed at the U.S. Navy’s Naval Air Weapons Station China Lake in California (“NAWS China Lake”), to pursue the Pre-feasibility Study-level validation of technology using a biodegradable fire retardant foam made with a composite of materials from Graphite One in extinguishing Class B fuel fires. The foam was developed by Graphite One’s technology development partner, American Energy Technologies Company of Arlington Heights, Illinois. Test results of experiments indicate that the foam formulation containing Graphite Creek material can extinguish Class B fires and therefore could meet the firefighting standards defined in U.S. Government Military Specifications.[5]

New liquid foam fire suppressants are critical to saving lives and safeguarding the environment and we are honored by the interest shown in the Company’s material by the U.S. Navy and other U.S Government departments and agencies.” noted Mr. Huston. “The global fire suppression market for systems and their related materials is expected to reach $18.3 billion by 2026[6] so this milestone represents an exciting opportunity for Graphite One to be part of this rapidly-expanding market”.

This development work is especially timely, given that the 2020 National Defense Authorization Act (NDAA) ordered that aqueous film forming foam (AFFF) must be phased out of use by October 2024 due to the dangers the material poses to the environment and human health. As of the 2024 deadline, AFFF agents will not be available for use in the event of an aircraft emergency involving Class B fires at any military installations or airfields.

“Our advanced graphite material work is driven by Graphite One’s commitment to serve the broad range of tech material applications that depend on graphite engineered to exacting specifications,” said Mr. Huston. “Battery grade anode material for EVs and lithium ion batteries will be the core of our commercial value, but we know that there is even more graphite can do to meet urgent demand in sectors ranging from environmentally-safe fire suppression to transformational technologies in the semiconductor sector and the new world of graphene. Each one of these product lines reinforces the value of Graphite One’s integrated supply chain solution – as well as our belief in the mission of our Company to provide the tech materials that drive global ingenuity.”

USGS Recognizes Graphite Creek as U.S.’s Largest Known Graphite Deposit

In March 2022, G1’s Graphite Creek resource was cited as the largest known graphite deposit in the United States by the U.S. Geological Survey (“USGS“) in its updated U.S. Mineral Deposit Database (“USMIN“)[7].

Graphite One Selects Washington State, Announces MOUs for its Complete U.S.-Based Supply Chain Solution

In spring 2022, Graphite One made a series of announcements advancing its plan to construct and operate a complete U.S.-based graphite supply chain,

In March 2022, Graphite One announced it had identified Washington State as the preferred location for the Company’s planned advanced materials processing plant, which it intends to bring production of battery anode active materials to the United States.

“This is a major step towards our proposed 100% U.S.-based advanced graphite supply chain,” said Anthony Huston. “Washington State offers the opportunity for Graphite One to use a green energy source – Washington state hydro – to manufacture a green energy material. That’s core to our commitment at Graphite One to make our project a model of ESG in action.”

In April 2022, Graphite one signed a memorandum of understanding (“MOU”) with Sunrise New Energy Material Co., Ltd., a Chinese lithium-ion battery anode material producer. The intent is to develop an agreement to share expertise and technology for the design, construction, and operation of Graphite One’s proposed U.S.-based graphite material manufacturing facility in Washington State – the second link in Graphite One’s planned U.S. supply chain solution for advanced graphite products.

Also in April, Graphite One entered into a non-binding initial MOU with battery materials recycler Lab 4 Inc. of Nova Scotia, Canada (“Lab 4”), whereby Graphite One and Lab 4 propose to collaboratively work together to design, develop and build the planned third link in G1’s complete supply chain; a recycling facility for end-of-life EV and lithium ion batteries, to be co-located at the Washington State advanced graphite materials facility.

2022 Drill Program

With exploration to date, the Graphite Creek resource continues to show potential to be an essential long-life component of the graphite supply chain.

G1’s 2022 Field Program included infill and step-out core drilling in the resource area. Additional core and sonic drilling were completed for geotechnical data collection at the proposed mill site, planned dry tailings/waste rock storage areas and the access route. A total of 2,090 meters were drilled, including infill drilling and exploration drilling on the geophysical anomaly. Core drilling in the deposit area continued to encounter visible graphitic mineralization over wide intervals consistent with previous drilling results as reported in 2021.

“With only about 7% of our 16 km geophysical anomaly incorporated in the PFS, which shows an after-tax NPV of US$1.4 billion, our 2022 Field Program gives us confidence the Graphite Creek Project is truly a generational strategic resource,” said Anthony Huston, CEO of Graphite One. “It is anticipated that the 2022 summer drilling program data will be incorporated in the feasibility study to advance Graphite Creek during this critical time of under supply for U.S. strategic materials such as graphite.” Drill results for the 2022 Field Program will be released when data analysis is completed. The deposit remains open along strike at depth and to the east and west.

In the Community

When emergencies arise, neighbors step up. In September, after Typhoon Merbok hit the Bering Strait region with 90 MPH winds and heavy rain, the Graphite One Alaska team partnered with Norton Sound Health Corp. to deliver frozen and perishable food to the Nome Food Bank, pallets of water, hand wash stations, clean up and sanitation supplies to the village of Teller, and drinks and canned food to Unalakleet, Shaktoolik and Golovin, coordinating the emergency deliveries with Bering Strait Native Corp. and the Red Cross.

Grant of Stock Options and Restricted Share Units

The Company announces that the board of directors has approved a grant of stock options and restricted share units (“RSU”) to its employees, officers, directors and consultants in an aggregate of 1,141,830 stock options with an exercise price of CA$1.08 being the closing price of the Company’s common shares on the TSX Venture Exchange on December 23, 2022 and 3,070,559 RSUs at a deemed price of CA$1.12 pursuant to the Company’s Omnibus Plan. The stock option and RSU grants to employees, officers and consultants vest over a three-year period and the stock options expire 5 years from the date of grant. The RSU grants to the directors vest 12 months from the date of grant and each vested RSU entitles the holder to receive one common share of the Company. The stock option and RSU grants are subject to the terms of the Omnibus Plan which was re-approved by the shareholders of the Company at the annual meeting of shareholders held on June 29, 2022, the applicable agreements and the requirements of the TSX Venture Exchange. These grants were made to appropriately reward the previous and ongoing contributions of the recipient employees, officers, directors, and consultants to encourage them to continue contributing significantly to Graphite One’s success in the future.

Following the grant, the Company had approximately 109,476,879 issued and outstanding common shares, 8,989,259 stock options issued and 3,070,559 RSUs issued.

Mr. Huston commented “With the added diversity of non-executive directors to the Board and to the committees, the Company adopted a new compensation program, which changed from granting in arrears to granting on a prospective basis, beginning in the first quarter of 2023”.

About Graphite One Inc.

GRAPHITE ONE INC. (TSX‐V: GPH; OTCQX: GPHOF) continues to develop its Graphite One Project (the “Project”), with the goal of becoming an American producer of high grade anode materials that is integrated with a domestic graphite resource. The Project is proposed as a vertically integrated enterprise to mine, process and manufacture high grade anode materials primarily for the lithium‐ion electric vehicle battery market. As set forth in the Company’s 2022 Pre-Feasibility Study, potential graphite mineralization mined from the Company’s Graphite Creek Property is expected to be processed into concentrate at a graphite processing plant. The proposed processing plant would be located on the Graphite Creek Property situated on the Seward Peninsula about 60 kilometers north of Nome, Alaska. Graphite anode materials and other value‐added graphite products would be manufactured from the concentrate and other materials at the Company’s proposed advanced graphite materials manufacturing facility expected to be located in Washington State. The Company intends to make a production decision on the Project upon the completion of a Feasibility Study.

On Behalf of the Board of Directors

“Anthony Huston” (signed)

For more information on Graphite One Inc., please visit the Company’s website, www.GraphiteOneInc.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed to be forward-looking statements. All statements in this release, other than statements of historical facts, are forward looking statements including statements relating to the timing, scope and completion of the anticipated Feasibility Study, receipt of regulatory approvals, possible impacts upon the Company of government grants and incentive programs, results of anode material testing, possible success and acceptance of advanced graphite material development and testing, exploration drilling, exploitation activities, future production, establishment of a processing plant and graphite manufacturing facility, conversion of MOUs into completed agreements, and events or developments that the Company expects. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions. Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date it is expressed in this press release, and the Company undertakes no obligation to update publicly or revise any forward-looking information, except as required by applicable securities laws. For more information on the Company, investors should review the Company’s continuous disclosure filings that are available at www.sedar.com.

| [1] See News Releases – “Graphite One Announces Closing CA$10 million in Financings and Awarding of Options” (February 23, 2021), “Graphite One Announces Closing of $10.23 Million in Private Placement Offering” (August 12, 2021) and “Graphite One Announces Closing of Second Tranche of $998,000 in Private Placement Offering” (September 24, 2021). |

| [2] G1 raised a total of CA$15,103,000 (US$11,590,000) on the issuance of 14,626,264 common shares at an average price of CA$1.03 (US$0.79) per share as well as the issued 9,296,328 common shares at a deemed Price of CA$90 per share to settle the Taiga Mining loan. |

| [3] Section 13502. Advanced Manufacturing Production Credit of Inflation Reduction Act of 2022; – https://www.congress.gov/117/bills/hr5376/BILLS-117hr5376enr.xml |

| [4] https://pubdocs.worldbank.org/en/961711588875536384/Minerals-for-Climate-Action-The-Mineral-Intensity-of-the-Clean-Energy-Transition.pdf |

| [5] https://www.graphiteoneinc.com/graphite-one-advances-foam-fire-suppression-test-work-at-the-u-s-naval-air-warfare-center/ |

| [6] https://www.reportlinker.com/p06095157/Fire-Suppression-Market-Report-Trends-Forecast-and-Competitive-Analysis.html |

| [7] https://www.usgs.gov/news/technical-announcement/usgs-updates-mineral-database-graphite-deposits-united-states |