Company Awaits Updated NI 43-101 Resource Estimate

Lithium is essential to the production of state of the art batteries that power electric vehicles and enable storage of renewable energy. Demand for the mineral has been rising and is expected to continue for the foreseeable future. The price of lithium has increased significantly over the past few years, and the investment landscape has changed around the critical mineral. Western nations are encouraging development of ‘friendly’ sources of lithium in the face of Chinese control of both the mining and processing markets. Automakers like GM are investing directly in mining operations to secure supply as they ramp up EV production.

In this context, lithium exploration companies are positioned at the nexus of large market forces. Here we will take a look at one such company, Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF), operating in the Argentine portion of the Lithium Triangle. A review of Lithium South’s new drill results combined with its historic confirmed resources, and put into context with recent acquisitions in the prolific lithium producing region, shed light on the potential for the company’s Hombre Muerto North (HMN) Lithium Project.

Drill Results and Resources

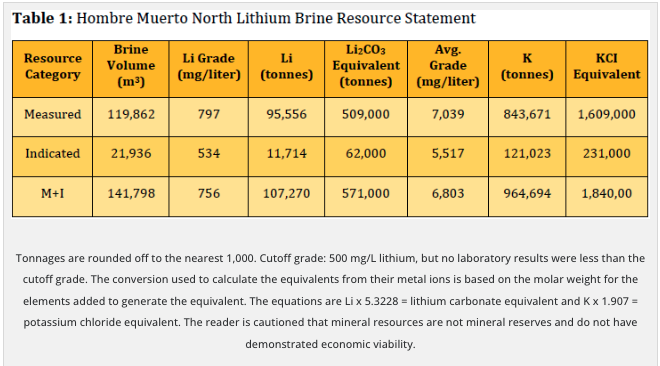

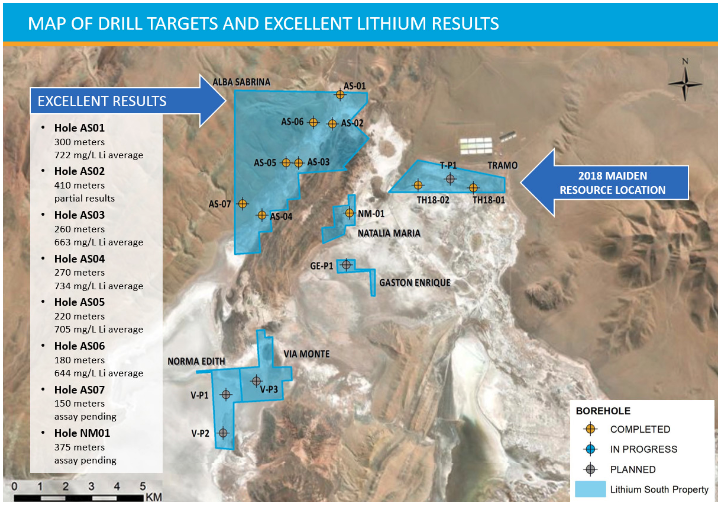

In 2018, Lithium South (at the time called NRG Metals) commissioned an NI 43-101 Technical Report on its Tramo claim block, comprising 3.6 square kilometers (about 14%) of a much larger block of wholly owned claims the company holds throughout the Salar del Hombre Muerto. The report showed a resource estimate of 571,000 tonnes of measured and indicated lithium carbonate equivalent (LCE). Lithium South also produced a Preliminary Economic Assessment that estimated the economics associated with developing a mine on the Tramo block.

Since then, Lithium South has expanded its drill program to two other blocks in the area, the Natalia Maria and Alba Sabrina blocks. With those drill holes now completed, about 75% of the company’s salar-located claims have been tested (inclusive of the 14% previously reported on the Tramo claim block). Lithium South is now waiting on an updated NI 43-101 resource estimate that will include the new drill results.

Though we can’t know how much LCE the new report will estimate, we can look at some drill results to gauge the potential. The company’s previous Tramo findings produced an average lithium grade of 756 mg/liter. Active lithium brine operations are built on deposits that can average between 300 mg/l to upwards of 1,000 mg/l, though the economics of any given project may vary depending on a wide range of factors. With those very general guidelines in mind, here are some drill results from Lithium South’s recently completed program.

Every hole on the Alba Sabrina block that has been analyzed and reported returned average grades in the mid-600 to low-700 mg/l range. These findings fall right in line with levels needed to move the project forward and represent high grade results. The one hole on the smaller Natalia Maria block, #NM-01, returned even higher grade results. NM-01 samples were very consistent from depths of 24 meters all the way down to 189 meters, producing concentrations between 1,071 mg/l and 1,246 mg/l.

Recent Acquisitions in the Area

It should be no surprise that there have been a flurry of lithium resource acquisitions across the globe in recent years considering the macroeconomic dynamics at play. Here are three deals from the past 5 years in Lithium South’s corner of Argentina. Taking a look at these acquisitions could serve as a barometer of the potential value of Lithium South’s claims, pending an updated resource estimate.

Lithium South properties border directly on POSCO Holdings property, and POSCO is investing $4 billion into a lithium processing and commercialization factory there with the intent of becoming the world’s third largest battery-grade lithium producer in the world by 2030. It’s a nice neighbor to have, and the investment certainly highlights the value of lithium production in the area. POSCO, a South Korean steelmaker, bought the mining claims surrounding LIS in 2018 for $280 million. The deal was based on 1.58 million tonnes of measured and indicated LCE resources, with another 0.96 million tonnes potentially inferred. So, including the inferred lithium resource, you’ve got $280 million for 2.54 million tonnes LCE, or about $110 million per million tonnes LCE.

Also in 2018, Chinese resource investment firm NextView New Energy bought Lithium X and its Argentinian claims for C$265 million, or about $200 million in US dollars. The deal was based around the Sal de los Angeles project and its 1.636 million tonnes of measured and indicated LCE resources, with another 412,100 tonnes of inferred resources. Including the inferred lithium resource, NextView bought about 2.05 million tonnes of LCE for $200 million, or about $100 million per million tonnes LCE.

In early 2022, Lithium Americas Corp. acquired Millennial Lithium and its Pastos Grandes brine project for about $400 million. A few months earlier, Millennial had been entertaining an offer from battery producer CATL for about $300 million. The Pastos Grande project has 4.12 million tonnes of measured and indicated LCE resources, along with another 798,000 tonnes of inferred LCE resources. Including the inferred resources, Lithium Americas bought about 4.9 million tonnes of LCE for $400 million, or about $82 million per million tons LCE.

General Guideposts

There are other considerations besides the measured, indicated, and inferred LCE resource that can affect the valuation of a lithium acquisition. These include existing infrastructure, purity of the resource, efficiency of the proposed operation, and other factors. But these deals provide a general range of what a defined lithium resource is worth in the vicinity of Lithium South’s Hombre Muerte North project.

With 14% of its salar-located claims (the Tramo block) already checking in with a measured and indicated 571,000 tonnes of LCE, the company is hoping to significantly expand the resource following completion of drilling on another 60+% of its salar-located claims. The new holes tested on the significantly larger Alba Sabrina block have returned similarly high grades as the Tramo results, and the Natalia Marina block turned in much higher grades on a smaller block.

The project sale ranges noted above were for projects at various stages of development all with unique lithium resources. We can’t determine a market value for the HMN Li Project, but we can reasonably believe a larger resource will have a larger valuation than the current market capitalization of $50 million. If Lithium South doubles it’s current resource, then the market capitalization should reflect that in a positive way. Of course we must await results to prove out our expectations.

Also important in valuing a lithium asset in the ground is what has been completed above the ground. Lithium South is currently testing a lithium recovery process which is conventional, industry accepted evaporation. Along with environmental permitting and plant design, LIS is moving the project toward a Feasibility Study. The valuation of projects that achieve this stage is usually much higher than at a preliminary stage. Lithium South has moved from being a lithium explorer to a lithium project developer, a move which bears watching in this era of high lithium demand.

Disclaimer: TDM Financial is paid a fee of $ U.S. 7,000 per month by Lithium South Development Corp (LIS) for advertising consultation. TDM Financial produced this advertisement on behalf of LIS and as such it should be considered advertising. Nothing written in this advertisement is meant to facilitate a trade in the shares of LIS, and is not to be considered investment advice. This advertisement is published for information purposes only and the reader is encouraged to do his/her own due diligence regarding LIS.

This advertisement contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward-looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

Mr. William Feyerabend, a Consulting Geologist and Qualified Person under National Instrument 43-101, participated in the production of this advertisement and approves of the technical and scientific disclosure contained herein.