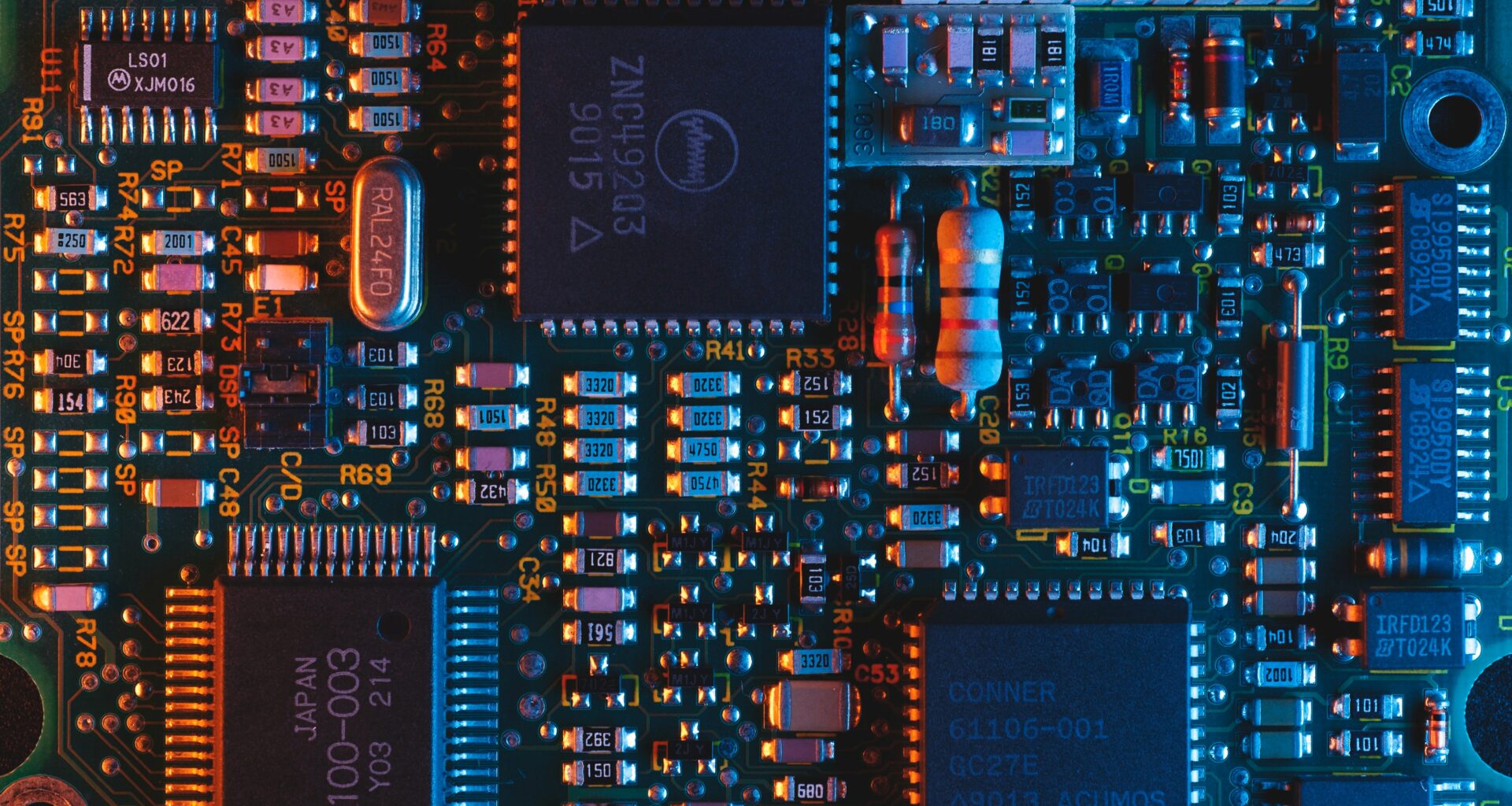

President Biden signed the Chip and Science Act into law on August 9, 2022, providing more than $200 billion to boost domestic production of semiconductor computer chips. The bipartisan bill aims to reduce reliance on overseas manufacturing for the chips that power nearly every part of modern technology – from smartphones to vehicle infotainment systems.

Let’s look at what companies could benefit from the $200 billion cash infusion immediately and in the future.

Domestic Semiconductor Manufacturers

Domestic semiconductor manufacturers, like Intel Corp. (INTC) and Micron Technologies Inc. (MU), are the most obvious beneficiaries of the Chip and Science Act. For instance, Bank of America analysts predict that Intel alone could receive $10 billion to $15 billion from the legislation over the next five years, providing a significant boost to its top-line revenue.

The act could also help some chipmakers execute their long-term vision. For instance, Micron Technologies has long been eyeing a mega fabrication plant that it could build in the U.S. with funds from the legislation. And Texas Instruments Inc. (TXN) could use the funds to speed up its buildout of U.S. manufacturing capacity.

In addition to manufacturers, Lam Research Corporation (LRCX) and other manufacturers of semiconductor manufacturing parts could also benefit indirectly from the bill as Intel, AMD Corp. (AMD), and others scale up their capacity. And there are only a handful of companies with the expertise to manufacture wafer fabrication equipment.

Research & Development Activities

The Chips and Science Act provides more than $50 billion in funding for research and development activities. While the National Science Foundation, Department of Commerce, and National Institute of Standards and Technology are big recipients, private companies working on cutting-edge innovation could also see more funding.

For instance, GBT Technologies Inc. (GTCH) sees growing demand for programmatic solutions to overcome the physics-related challenges of developing sub-5nm chips. The company’s non-provisional patents in the space, like its recent patent on automated LVS correction, could help push past these challenges and support domestic innovation.

GBT Technologies is also researching 3D MP microchip architecture, offering new ways to design and manufacture integrated circuits to fit advanced analog, digital, and mixed-type ICs on a silicon wafer. At the same time, these technologies use less silicon space, resulting in lower costs, lower power consumption, and better performance.

Looking Ahead

The Chip and Science Act will provide more than $200 billion in funding to scale up semiconductor capacity in the U.S. and accelerate domestic research and development. The move promises to reduce dependence on global semiconductor manufacturing while creating more capacity and jobs in the U.S. to support the industry.

Investors looking to capitalize on the new funding could look to semiconductor manufacturers, like Intel, Micron, or Texas Instruments, or toward research-focused organizations like GBT Technologies.

For more information on GBT Technologies, visit the company’s website or complete the form below to receive their investor presentation.