About 90% of the world’s plastic waste is not currently recycled, and despite oft-stated goals put forth by corporations and governments alike, that figure hasn’t changed much over the past few years. The problem lies in large part with the current technologies being used.

Mechanical recycling is the most prevalent form of plastic recycling, using grinding, washing, sorting, and reprocessing to repurpose plastic material. Effective sorting of the plastic types is crucial to mechanical recycling’s success, as only one type of plastic at a time can be recycled this way. Polyethylene terephthalate (PET) and high-density polyethylene (HDPE), the types of plastics that make up many beverage bottles and food containers, lend themselves to mechanical processing.

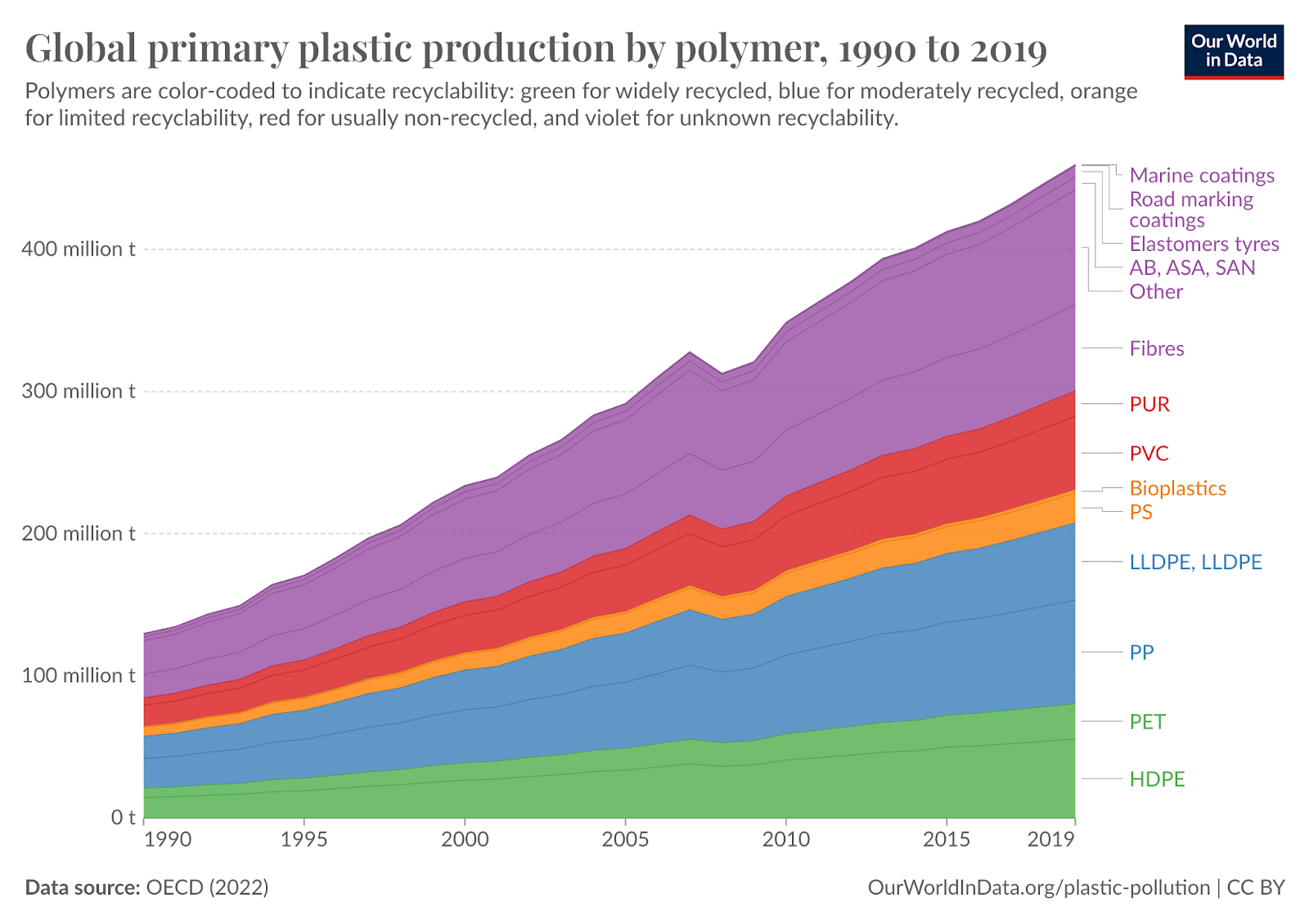

According to the Organization for Economic Cooperation and Development, as of 2019 PET and HDPE (the green part of the graph above) together comprised about 17.5% of global plastic production. According to the EPA, in 2018 the United States recycled about 29% of each of these types of plastic. The rest of the plastic is either moderately recycled or effectively not recycled at all. These dynamics leave a gaping shortage in the quest to create a circular economy for plastic and a huge market opportunity for new technologies capable of handling more diverse types of plastics.

Advanced or Chemical Recycling

In response to the shortcomings of mechanical recycling, new technologies collectively known as ‘advanced’ or ‘chemical’ recycling have emerged. Rather than grinding down plastic into smaller bits of the same material, these technologies change the chemical structure of the plastic by breaking down long hydrocarbon chains into shorter ones. The result is a feedstock that can be made into new plastics or other chemical products.

Pyrolysis is the most common method of advanced recycling, utilizing very high heat to break the long chains. It is energy intensive, not super efficient, creates high emissions, and it still usually requires extensive sorting and cleaning. Pyrolysis, while the most common form of advanced recycling, is still not prevalent in the marketplace due to these limitations. It also works best on polyethylene and polypropylene, but not so well on the wider variety and volume of other plastics.

A More Diverse Solution

Aduro Clean Technologies, Inc. (CSE: ACT) (OTCQB: ACTHF) (FSE: 9D50) is currently in the process of commercializing its own version of advanced recycling. It’s called Hydrochemolytic™ Plastic Upcycling (HPU), and it offers several major advantages over systems currently on the market.

HPU works in a water-based environment, which requires far less heat (lower costs, lower emissions) than pyrolysis. It is capable of processing almost any kind of plastic rather than just focusing on one or two types. The technology is highly scalable and relatively low-cost to build compared to the giant factories and collection centers currently required to run recycling operations.

Though Aduro is technically pre-commercial, it is very active in engaging potential clients through its Customer Engagement Program (CEP). After developing HPU for years below the radar, the company is utilizing its demonstration unit to prove, test, and further improve performance in relation to a variety of feedstock.

Aduro recently announced its sixth participant in the CEP. These companies are multinational and multibillion-dollar organizations that we all have heard of, though they are remaining anonymous at this point. In just a few months, Aduro has brought on petrochemical giants, a major food packaging company, and now a building materials outfit with manufacturing operations in over 20 countries.

This latest announcement demonstrates the broad applicability and market potential of HPU technology. Moving well outside the PET and HDPE comfort zone, the new customer is testing the recyclability of cross-linked polymers. From the press release: Cross-linked polymers, essential and versatile materials, are foundational across a myriad of industries due to their superior durability, chemical resistance, and mechanical strength. They are ubiquitous and found in everyday items such as automotive tires, rubber tires, conveyor belts, seals, tubes, hoses, household adhesives, protective coatings, and medical devices. Moreover, their significance extends to critical sectors like aerospace, automotive, construction, and electronics, where their exceptional properties are indispensable.

However, the very attributes that make cross-linked polymers invaluable also pose a significant recycling challenge. Unlike thermoplastics, these materials do not melt under heat; instead, they are exceedingly difficult to decompose. When subjected to the very high temperatures necessary for their breakdown, they primarily degrade into char and fuel gas, substances unsuitable for repurposing into new materials. This limitation not only underscores the need for innovative recycling technologies but also highlights the urgency of developing sustainable lifecycle management strategies for cross-linked polymers.

Aduro recently shared incredibly efficient results from its polypropylene test runs, representing just a sampling of the testing the company has completed utilizing various feedstocks for its potential clients. 95% of the polypropylene was converted to highly saturated hydrocarbon feedstock that doesn’t require further processing to be used to form commercially viable second generation products. Only 5% went to waste, as carbon and fuel gas.

Polypropylene accounts for about 15.8% of global plastic production and is currently difficult to recycle. If HPU can process even a fraction of that market (73 million metric tonnes annually) with the effectiveness already demonstrated on a small scale, the company’s current $69 million valuation would look like a misprint. If you add in the potential to recycle other types of plastics and hydrocarbons, like the building materials currently being tested or any of the other categories in the chart at the top, then the true scale of the opportunity emerges.

The potential for growth is startling for a little Canadian company with a market cap of less than US$75 million that spent the last several years in the lab developing the Hydrochemolytic™ process. Stay tuned as Aduro Clean Technologies continues to announce new potential clients and is on the road to a commercial-scale pilot plant in the coming quarters. For this company addressing this market, the time is ripe, and things are moving fast. Don’t miss it.