Aduro Clean Technologies (NASDAQ: ADUR) (CSE: ACT) (FSE: 9D50) is gaining momentum as a potential game-changer in the cleantech sector. With its innovative Hydrochemolytic™ Technology (HCT), Aduro is addressing some of the most pressing challenges in recycling and energy production. Recently, an analyst from D. Boral Capital set a bold $50 price target for Aduro, representing an 842% upside from its current trading price of $5.31.. However, some investors believe this target may be conservative, with projections suggesting the stock could skyrocket even further as the company scales its operations.

The Analyst’s Valuation and Why It May Be Conservative

D. Boral Capital’s $50 price target is based on a discounted cash flow (DCF) analysis and earnings-per-share (EPS) projections. The analyst assumes Aduro will capture just 0.5% of the $120 billion advanced plastic recycling market by 2030, generating significant revenues from licensing its technology to industrial partners. However, a deeper dive into Aduro’s competitive advantages reveals that this modest assumption might not fully reflect its potential:

- Market Share Opportunity: Aduro’s HCT platform outperforms traditional recycling methods by efficiently breaking down plastic waste into valuable raw materials, achieving up to 95% yields compared to competitors’ 70%-80%.

- Pricing Premiums: The forecast assumes recycled plastic will sell at the same price as virgin plastic, but recycled materials often command a premium due to increasing demand for sustainable solutions.

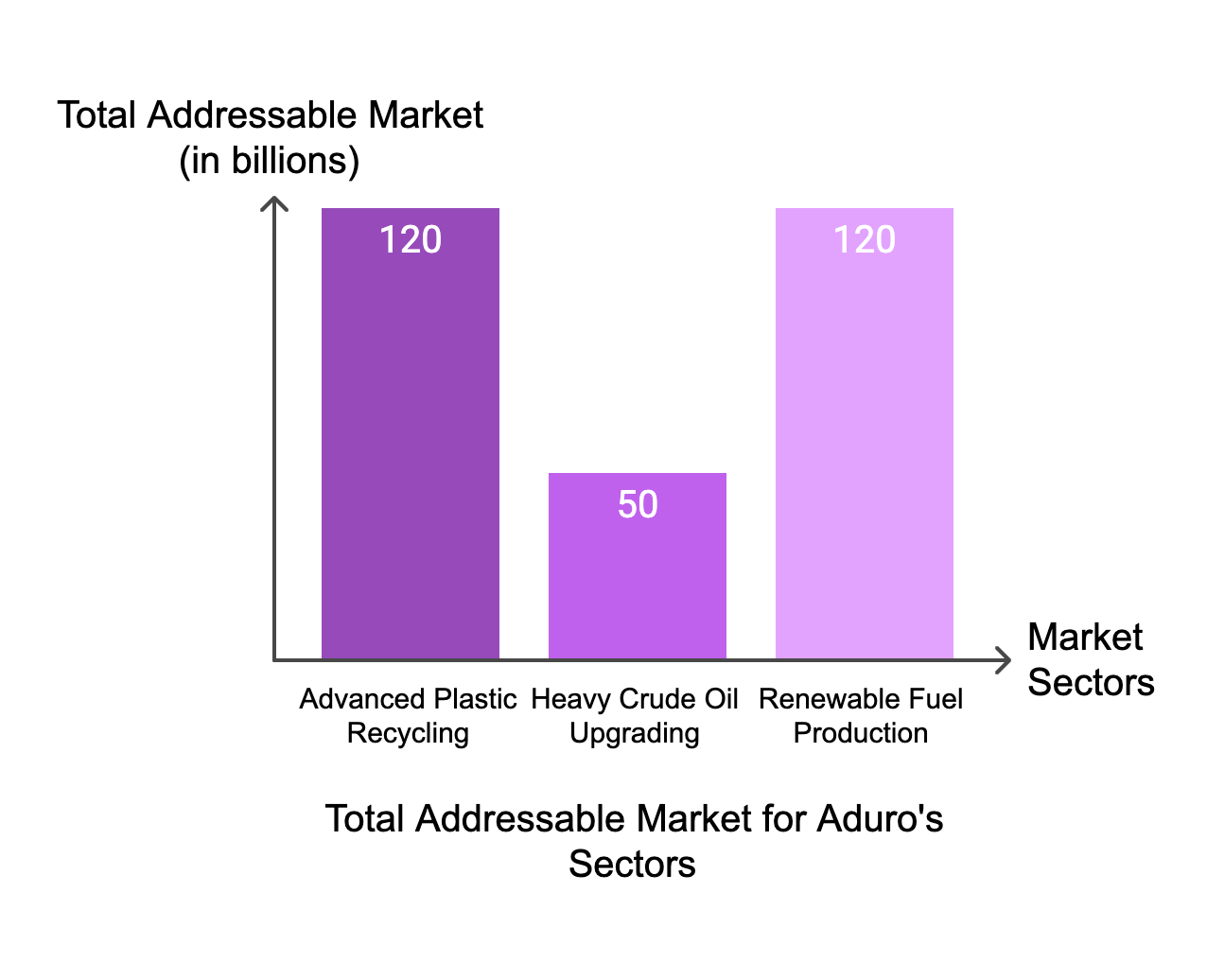

- Overlooked Revenue Streams: The analyst’s valuation focuses solely on plastic recycling, ignoring Aduro’s potential in heavy crude oil upgrading ($50 billion market) and renewable fuel production ($120 billion market), which could unlock billions in untapped revenue opportunities.

What Makes Aduro a Standout Investment?

Aduro’s technology is not just innovative—it is disruptive. Its Hydrochemolytic™ Technology uses water-based chemistry to break down plastics and other feedstocks into their original components at lower temperatures and costs than traditional methods. Here’s why investors are excited:

- Multi-Feedstock Capability: Unlike many competitors that recycle only one type of plastic, Aduro can process polyethylene (PE), polypropylene (PP), and polystyrene (PS)—materials that make up over 55% of global plastic production.

- Capex-Light Business Model: Aduro plans to license its technology to industrial partners rather than building expensive facilities itself, allowing for faster scaling with minimal capital expenditures.

- Industry Validation: Global energy giant Shell has partnered with Aduro through its GameChanger program, providing technical expertise and non-dilutive funding to accelerate commercialization. Aduro is collaborating with TotalEnergies as well. Additionally, Aduro has ten active engagements with multi-billion-dollar corporations, setting the stage for lucrative licensing deals.

Financial Potential Backed by Massive Market Opportunities

Aduro operates within three high-growth markets with a combined total addressable market (TAM) of $290 billion:

- Advanced Plastic Recycling ($120 Billion TAM): With global governments and corporations committing to sustainability goals, demand for advanced recycling solutions is surging. If Aduro captures even 1% of this market, it could generate over $1 billion annually in revenue.

- Heavy Crude Oil Upgrading ($50 Billion TAM): Aduro’s technology can improve the quality of heavy crude oil at lower costs than traditional methods—an attractive proposition for oil producers looking to maximize profitability.

- Renewable Fuel Production ($120 Billion TAM): As the world transitions to cleaner energy sources, Aduro’s ability to convert waste oils into renewable fuels positions it as a key player in this rapidly growing sector.

Risks to Consider

While the growth story is compelling, investors should be aware of certain risks:

- Pre-Revenue Stage: Aduro is still in its pre-commercialization phase and has yet to generate significant revenue streams.

- Execution Challenges: Scaling operations and securing long-term contracts with industrial partners will be critical milestones that could impact timelines and profitability.

- Market Competition: While Aduro’s technology offers clear advantages, it will face competition from established players in the recycling and energy sectors.

However, these risks are mitigated by strong industry validation (e.g., Shell partnership) and a capex-light business model that reduces financial strain during scaling.

Why Now Is the Time to Act

For forward-thinking investors looking to capitalize on cutting-edge cleantech innovation, now may be the ideal time to consider Aduro Clean Technologies. At a modest market cap of about $150 million, the company trades at a fraction of its potential value based on even conservative projections.

Aduro Clean Technologies represents a rare opportunity in today’s market—a micro-cap company with groundbreaking technology poised to disrupt multiple billion-dollar industries. While risks remain due to its early-stage development, the combination of industry validation, strong partnerships, and massive market opportunities makes it an attractive investment for those willing to take a long-term view.

With analysts already projecting an 842% upside—and potential for exponential growth beyond that—Aduro offers investors an exciting chance to participate in shaping the future of recycling and renewable energy innovation.