LEEF Brands Inc. (CSE: LEEF) (OTCQB: LEEEF) is one of California’s leading cannabis extraction companies, providing high-quality extracts for most of the biggest brands in the world’s largest legal cannabis market. LEEF has been generating about $30 million in annual revenue for the past three years and is now implementing plans that should improve that revenue number while also significantly boosting the company’s margins.

The company recently announced one of those moves – LEEF is opening up shop in New York. LEEF has been discussing the possibility of becoming a multi-state operator (MSO) if it makes sense, and New York may be just the first with more to follow. Here we’ll take a look at LEEF’s move and how it fits with the company’s overall plan to grow revenues, increase margins, and eventually become the world’s largest vertically integrated extraction company.

LEEF Brands’ CEO Micah Anderson discusses the expansion into New York in this interview.

Advantages of LEEF’s New York Deal

Minimal Investment of Capital and Time

LEEF is moving into a 7,000-square-foot facility with its extraction equipment ready in New York. The launch should be painless with the assets in place. Additionally, should the company decide to expand production there in the future, it will not require much capital to do so.

Expanded Market Reach

By operating in multiple states, LEEF Brands can significantly increase its brand exposure and customer base. This expanded reach allows the company to tap into diverse markets, each with its unique consumer preferences and demand patterns. Operating as an MSO can help LEEF achieve accelerated revenue growth and establish a strong foothold in the key New York market, setting the stage for further expansion as opportunities arise.

Established Sales Channels

LEEF already works with most of the top brands in California, the originating market for almost all cannabis industry innovations and developments. Many of these customers already have operations in New York (and other states) and have been pushing LEEF to expand. These relationships should provide a sales ramp that allows for quicker revenue generation.

Risk Mitigation

The cannabis industry is subject to complex and often changing regulations, which can vary significantly from one state to another. Operating across multiple states creates a crucial hedge against state-specific regulatory risks while also providing options in the face of catastrophic weather events like floods or fires. By diversifying its operations geographically, LEEF can better withstand potential challenges in any single market, ensuring greater stability and resilience for the business.

Large High Growth Market

New York’s cannabis market is growing rapidly. According to New York State’s Office of Cannabis Management, sales have surged from $160 million in 2023 to an estimated $1 billion in 2024, with projections of $1.5 billion by 2025. Concentrates play a significant role in this growth, as they are used in over 55% of all products sold in the state.

The Investment Opportunity

With a market cap around $27 million, LEEF currently trades well below the revenue multipliers of some of the more successful public cannabis companies. That ratio could correct itself if the company performs as it hopes in 2025.

Alongside the expansion into New York, LEEF is set to plant 65 acres of its own crops on the company’s Salisbury Canyon Ranch near Santa Barbara. By 2027 the plan is to have all 187 acres of licensed cultivated land in production, creating one of the world’s largest outdoor cannabis farms.

Source: LEEF Brands Corporate Presentation

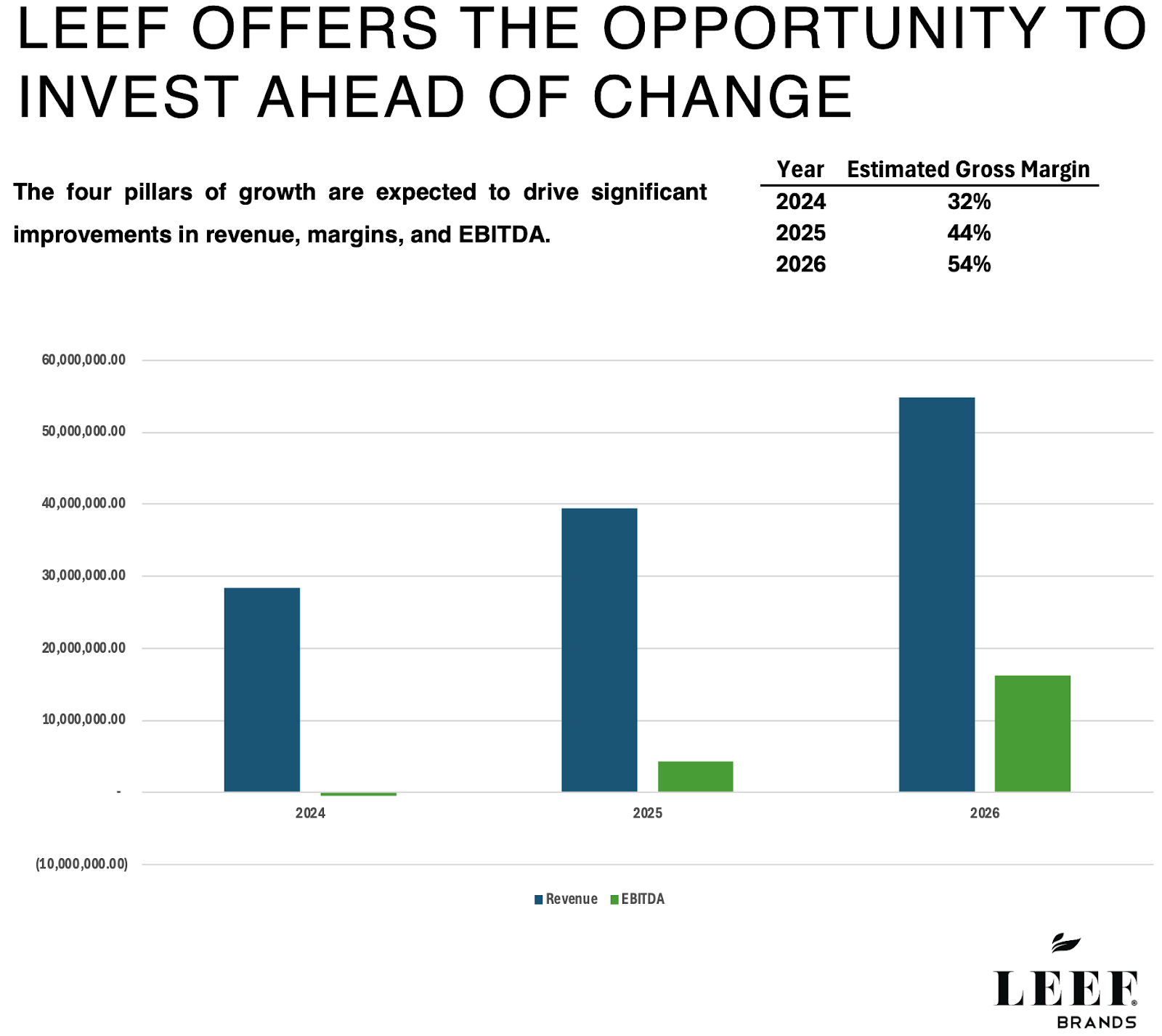

The company currently gets its feedstock for extraction from a network of over 200 California growers. At full production, the Ranch would be able to supply all 3+ million pounds of feedstock necessary to operate at 100% extraction capacity of its current equipment. By growing its own cannabis, LEEF expects to boost margins from 32% in 2024 to 54% in 2026. This would be a huge boon for a company that is presently teetering on the edge of being cash flow positive.

Source: LEEF Brands Corporate Presentation

Overall, much of the investment in the Ranch has already been done and the New York expansion is not very capital intensive. With the potential to greatly expand revenues while also boosting margins by 20% or so, the table is set for LEEF Brands to deliver tremendous value to its shareholders this year and beyond.

Interested investors can access the full LEEF Brands corporate presentation here.