From an investor’s perspective, the cannabis industry has had a rough go of it over the last few years as legalization has spread across North America. While business opportunities and story-based stocks have been plentiful, and valuations were often sent sky high based on potential, the rubber met the road when continually disappointing financial results failed to meet investor expectations.

There is, however, a lot of money to be made in legal cannabis. The right business model, in the appropriate market, with high quality products, and run by experienced managers focused on the bottom line — it’s not easy, but it can happen.

LEEF Brands Inc. (CSE: LEEF) (OTC: LEEEF) may well represent just such a business. Specializing in the manufacturing of a wide variety of cannabis extracts, LEEF is branching out into cultivating its own plants on the wholly-owned Salisbury Ranch property in the Santa Barbara area. Already one of the leading extractors in California, the move is designed to boost profit margins and exert control over the company’s supply chain. LEEF has already been reporting positive adjusted EBITDA on about $30 million of annual revenue and currently trades with a market capitalization of around $20 million.

The Current Business

LEEF’s core business is providing extracts on a wholesale basis to brands and retailers. The company uses the most advanced technology in three types of extraction – solventless, ethanol, and hydrocarbon. In addition, LEEF’s industrial kitchen produces edibles, gummies, and chocolates made from these extracts. All of this is housed in the company’s LEEF Labs facility in Willits, California, in the heart of the state’s famed Emerald Triangle. LEEF Labs sits on a 14 acre campus that allows for easy expansion as the business grows. The company can currently extract about 1 million pound per year at full capacity.

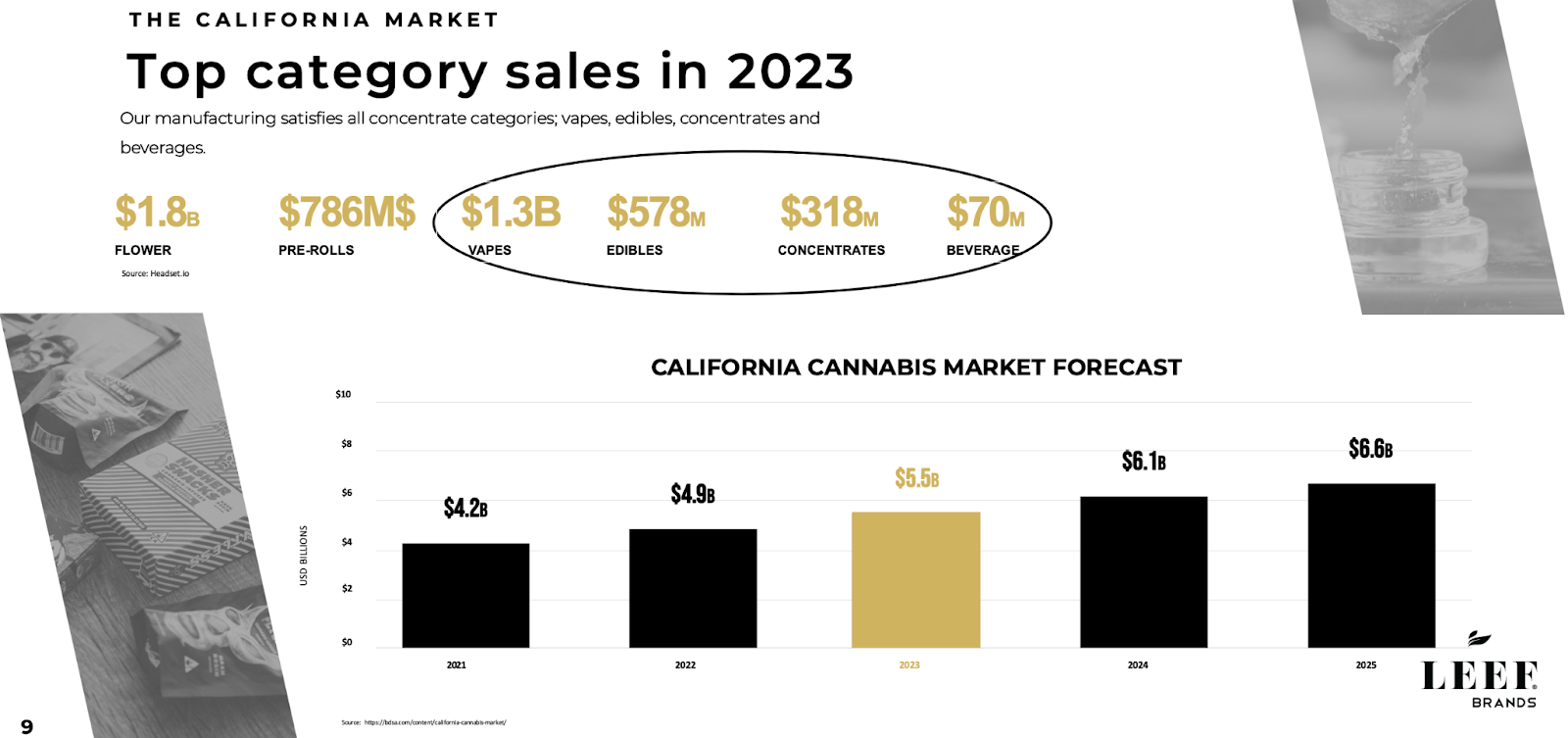

Serving California, the world’s largest legal cannabis market, LEEF is addressing about 41% of the state’s total market, or about $2.23 billion out of the $5.5 billion of sales recorded in 2023. The addressable market for LEEF’s extraction business includes vapes, edibles, concentrates, and beverages, while the balance consists of flower and pre-roll sales.

LEEF creates products for a broad range of leading California cannabis brands, and buys its raw cannabis materials from several of the best cultivators in the state. Every batch of incoming and outgoing product is thoroughly tested to ensure the highest quality possible. The company believes its commitment to best-in-class concentrates and services has been essential to the success of its brand partners.

Overview of LEEF Clients

LEEF has also developed its own LEEF Organics brand, focused on wellness, lifestyle, and CBD categories. The LEEF Organics line is sold by spas and retailers throughout the United States. In addition, the company operates a high end dispensary of its own in Palm Desert. Located in a world class art, dining, and retail district, The Leaf El Paseo reflects the company’s commitment to the highest quality products and expert, individualized service.

How LEEF is Improving

The biggest development for LEEF and its investors is definitely the ranch facility in Santa Barbara. The company holds cultivation licenses allowing for 187 acres of cannabis canopy, 65 acres of which is scheduled to be planted in 2025. By 2027, LEEF expects to have all 187 acres planted, with an anticipated biomass yield of about 1.3 million pounds to fuel its extraction business.

Over $7 million has been invested in the purchase of the real estate as well as key infrastructure projects including wells and irrigation systems, cameras and fencing, road improvements, engineered pads, and field preparation and related permits. “The completion of the first phase of Salisbury Canyon Ranch represents a major achievement for our team after a long road to get here,” said Micah Anderson, Chief Executive Officer of LEEF Brands. “This addition to our internal supply chain is expected to significantly drive revenue and margin growth in 2025, positioning us well for continued success.”

LEEF also has a hemp cultivation permit for the property which will allow it to make a larger future commitment to its CBD operations should market conditions point in that direction. Development of the ranch property basically enables the company to allocate resources to either cannabis or CBD, depending on how the regulatory environment changes for either vertical.

LEEF anticipates that the vertical integration of production from the Salisbury Canyon Ranch will add about 19% gross margin to its operation when compared with the current model of acquiring raw plant material from other growers. The company currently operates with gross margins in the 30% range, on average. Many similar companies in the industry create gross margins in the 40-50% range, so the new production facility will bring LEEF up to and potentially exceed its competitors in terms of margins. As is, the company has already been reporting positive adjusted EBITDA, something of a rarity in the cannabis industry.

The Upshot

The U.S. Drug Enforcement Agency is holding hearings to reschedule cannabis from a Schedule I to a Schedule III drug, a move that has been in process since 2022. If the rescheduling happens, it could open up interstate business in the industry, as opposed to the current situation where all business must be conducted exclusively within each state. These things take time, obviously, but the writing is on the wall with 38 states currently allowing medical use and 24 states allowing recreational use. LEEF is poised to expand its operations should that come to pass.

In the meantime, LEEF has positioned itself to improve its already successful business in California with regulations as they currently stand. In a depressed capital market like the current cannabis industry, the high performers will still rise to the top. Keep an eye on LEEF Brands as the company seeks to do just that.