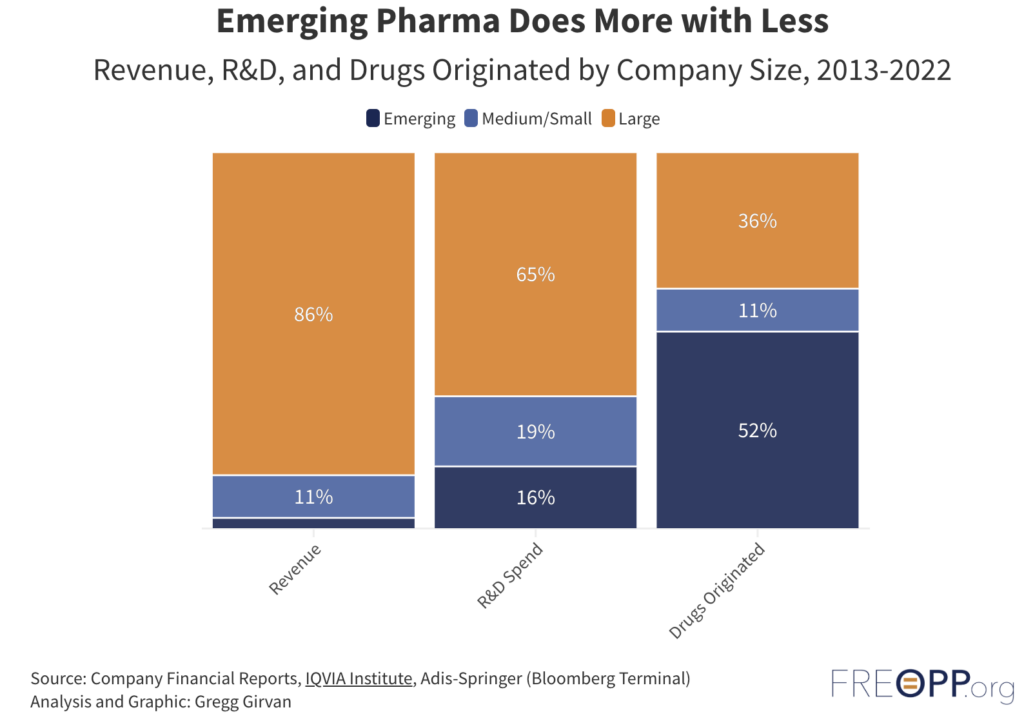

Small pharmaceutical developers have been responsible for the clinical trials of the majority of FDA-approved drugs over the last several years. Early-stage companies, working with fewer resources and vastly smaller revenues than larger industry peers, brought from 54% to 62% of the FDA-approved drugs to the clinic in each of the years from 2016-2022. Investors looking for innovation in the pharmaceutical industry should be considering smaller drug companies.

What’s more, the trend of small companies developing drugs through trials only to sell the rights (or the company) to big pharma has decreased. In 2013, 23% of emerging companies retained rights to their drugs throughout the FDA approval process. In 2022, 75% percent of them did.

These trends point toward the significant upside for small company drug developers. This path also presents risks, of course, that are not as prevalent for the giants of the industry. Failed trials can doom emerging companies whereas large companies can absorb more misses. The flipside of this coin is that successes have an outsized impact on the valuations of small companies compared to more established ones with many drugs on the market.

One small company, Cardiol Therapeutics Inc. (Nasdaq: CRDL) (TSX: CRDL) has recently wrapped up one Phase 2 trial for a rare, but debilitating heart condition, while simultaneously conducting a separate Phase 2 trial of the same drug candidate, called CardiolRx™. Cardiol anticipates a Phase 3 trial will follow from the first trial and is eagerly awaiting results of the second one. Cardiol is the type of company investors should have on their radar: market cap around $160 million; two drugs and three trial programs in its pipeline; and an Orphan Drug Designation from the FDA in hand.

Recurrent Pericarditis Trial

Cardiol recently announced the completion of the full course of its Phase 2 study in recurrent pericarditis – the MAvERIC-Pilot study. The complete results are to be presented in November at the American Heart Association’s Scientific Session. The company earlier announced positive topline data from the initial 8-week treatment period, and the full results will reflect an additional 18-week period that tested CardiolRx™ for continued pain relief and prevention of a recurrence.

Pericarditis is the inflammation of the sac surrounding the heart and is the condition for which Cardiol was granted the Orphan Drug Designation. Recurrent pericarditis covers cases in which symptoms return after the initial infection, often coming back more than once. Symptoms include debilitating chest pain, shortness of breath, and fatigue, resulting in physical limitations, reduced quality of life, emergency department visits, and hospitalizations.

“The MAvERIC-Pilot study was designed to investigate the impact of our novel therapy CardiolRx™ in patients with the debilitating symptoms of recurrent pericarditis,” said Andrew Hamer, Cardiol Therapeutics’ Chief Medical Officer and Head of Research & Development. “Having reached the important milestone of concluding the study, we now look forward to reporting the full clinical results from MAvERIC-Pilot that will include additional endpoints including freedom from pericarditis recurrence during the 18-week Extension Period, 26-week pericarditis pain score and inflammatory marker levels, and safety and tolerability outcomes. We anticipate the totality of the results will support and further inform our plans to advance to a Phase III trial of CardiolRx™ in this inflammatory heart disease that is associated with symptoms that adversely affect quality of life, mental health, and physical activity.”

Other Trial Programs

Cardiol is in the midst of another Phase 2 trial, the ARCHER trial assessing the impact of CardiolRx™ on acute myocarditis patients. Myocarditis is the inflammation of the heart muscle itself, and acute cases are a leading cause of sudden cardiac death in young people. Acute myocarditis is a condition which would also qualify for the FDA’s Orphan Drug Designation, a program designed to support and encourage the development of drugs that treat conditions affecting less that 200,000 Americans annually. Benefits of the designation include tax credits for qualified clinical trials, exemption from user fees, and potential seven years of market exclusivity after approval.

These types of incentives are even more important to a company the size of Cardiol than they would be to multinational pharma companies. Cardiol intends to pursue an Orphan Drug Designation for its acute myocarditis program, on top of its existing one for pericarditis.

The company also has another form of its drug candidate in pre-clinical studies for the treatment of heart failure. Their heart failure drug candidate, CRD-38, is injected subcutaneously, whereas CardiolRx™ is an oral formulation. Heart failure is one of the leading causes of death worldwide, it has been estimated to require around 1 million hospitalizations annually in the United States, and the 5-year mortality rate for those living with heart failure is above 50%.

What’s Next

Cardiol Therapeutics is scheduled to present the complete results of the recurrent pericarditis MAvERIC-Pilot study in November and is working toward a follow-up Phase 3 trial. The Phase 2 ARCHER trial for acute myocarditis should be working its way to its conclusion as enrollees are monitored for a 12-week period and the trial passed the 80% enrollment mark recently.

Cardiol is a small, pre-revenue drug developer offering multiple avenues toward a potential drug approval. As of the end of the second quarter, the company reported $24 million cash in its coffers, enough to fund operations into 2026. Considering the trend toward smaller companies developing drugs through approval, Cardiol Therapeutics definitely should be on investors’ radars.