Rising prices have attracted investors to the uranium market recently, and with good reason. Spot prices for U3O8 topped $60 in September, for the first time since before the Fukushima nuclear disaster in 2011, and have continued to climb since. Uranium topped $70 before a slight pullback recently and the rising prices are predicted to continue for the foreseeable future. According to SP Angel mining analyst John Meyer, “The market has been slowly building higher prices as mining costs rise and nuclear generators look to build stocks to guard against increasingly risky supply-side issues. We see prices rising year-on-year for next 10-20 years or till the world finds another source for large scale uninterruptible base load power with a low carbon footprint.”

Source: Numerco.com Uranium Spot Price USD/Lb U3O8

Fukushima had a global chilling effect on new nuclear energy development, but governments are returning to the idea as they search for carbon-free sources of power. A series of recent geopolitical events, including a coup in Niger and the Russian invasion of Ukraine, have helped constrict the supply while demand continues to increase. Cameco, the world’s largest miner of uranium with operations in Canada’s Athabasca Basin, recently added to the supply/demand pressure when it announced lower full-year forecasts for production.

On a longer-term basis, the World Nuclear Association anticipates demand for uranium will likely double by 2040. Currently, mines supply around 85% to 90% of global demand while the balance is made up by secondary supply sources such as stockpiles held by utilities and governments. These secondary sources are dwindling, however, and they are anticipated to supply only 4% to 11% of the demand by 2050. In short, more uranium mines are needed to meet skyrocketing demand.

Governments have taken note, including the US and Canada. Uranium was removed from the US list of critical minerals due to a technicality in the Energy Act of 2020, but it remains essential and could be reinstated to the list soon. In Canada, uranium is a focus of the critical minerals strategy. Canada also happens to be home to the world’s richest uranium deposits, found in the Athabasca Basin. Canada has committed $3.8 billion to support critical mineral exploration, including uranium, and also offers a 30% Critical Mineral Exploration Tax Credit to companies developing new sources of critical minerals, including uranium.

In short, if one were interested in investing in the future of global energy development, new sources of uranium should probably be on the short list. And new sources of Athabasca Basin uranium should probably be high on that short list. One of the more interesting explorers in the region is Stallion Discoveries Corp. (TSX-V: STUD) (OTCQB: STLNF). Stallion is mineral-agnostic in its approach, with gold, antimony, and uranium all in its mix of promising properties, but the company has been focused on its large (and growing) land package in the Athabasca Basin and has assembled a team of veterans to lead the development of its uranium assets.

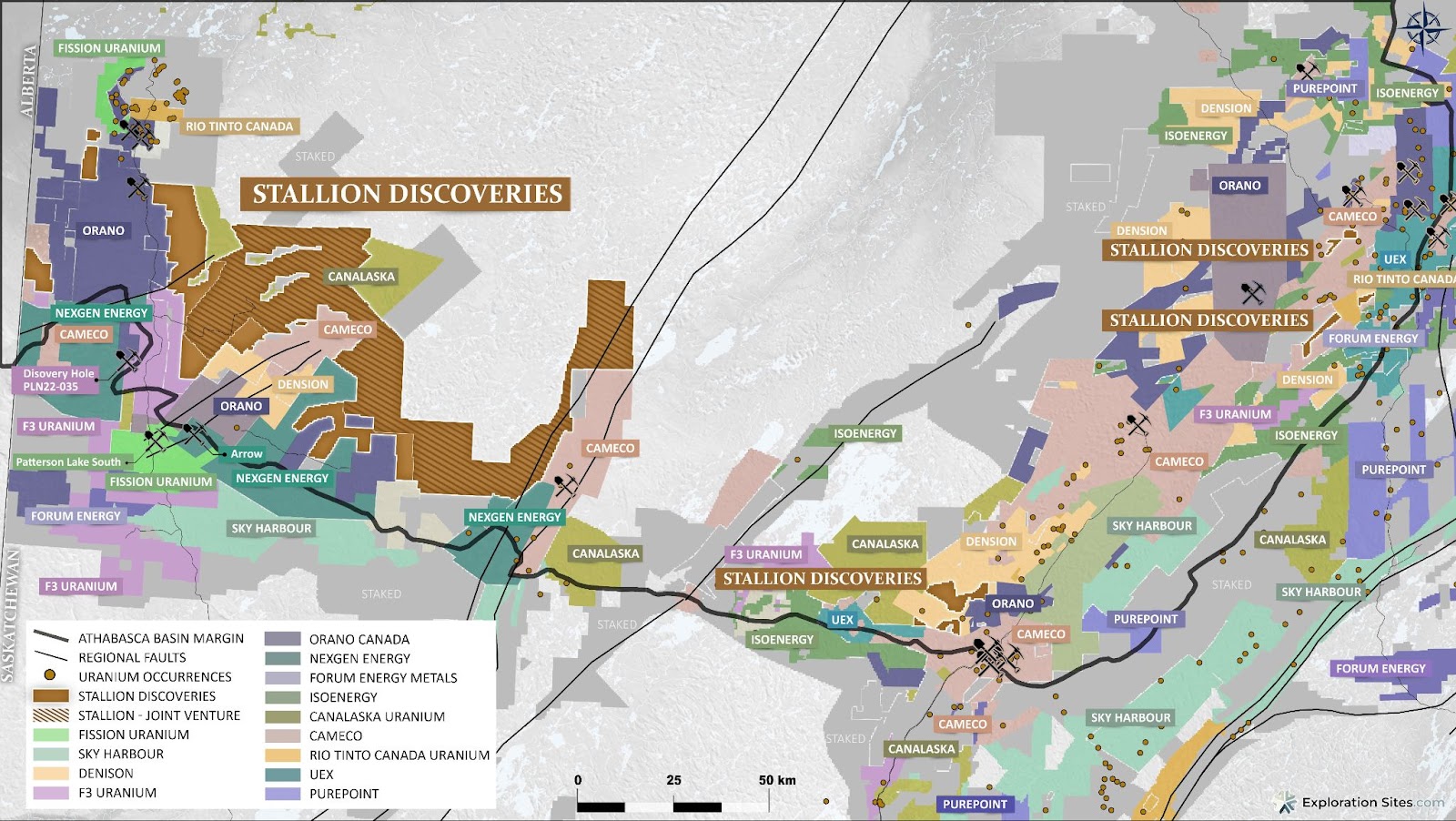

Stallion Discoveries’ Holdings

Stallion Discoveries currently owns 194,796 acres of claims in the basin and has closed an option agreement to acquire a 70% interest in another 547,524 acres of claims through a joint venture with ATHA Energy Corp. This will result in a total of 742,320 acres, of which 692,647 acres will comprise the largest contiguous project in the western portion of the basin.

This land package was strategically built for its proximity to major discoveries and development projects while still being largely underexplored. Stallion believes it has created significant discovery potential that will be unlocked by utilizing modern exploration techniques.

Map of Stallion Discoveries’ complete Athabasca Basin land package

Stallion’s current holdings and the new additions, all shown together in the map above, share significant borders with projects held by Cameco Corporation, Orano Canada, NexGen Energy, Denison Mines Corp, and F3 Uranium (formerly named Fission 3.0). The company expects the scale and strategic location of the asset base will provide numerous high-potential target zones along several major trends.

As an example of the area’s potential, F3 Uranium made a discovery of uranium deposits as high as 59% purity and averaging nearly 7% purity on property directly bordering Stallion claims. For reference, many existing mines work with grades well below 1% and as low as 0.02%.

Of course, proximity does not guarantee results. But the geology of the area points to the potential, and Stallion completed an extensive VTEMTM Plus electromagnetic (EM) and magnetic survey that covered all of the company’s 100% owned 194,796 acres in the Basin. The data from the survey has now been interpreted, and the company has identified four target zones for its initial drill program this fall/winter. Stallion also plans to complete an electromagnetic survey of its holdings covered by the joint venture with Atha.

“Identifying these several highly prospective target areas across Stallion’s large land package gives us a strong opportunity to discover the next significant uranium deposit in the basin,” stated Drew Zimmerman, Chief Executive Officer. “Historically, our land package was largely overlooked but with the new mining methods and technologies continuing to be developed, our projects are now becoming extremely relevant for future uranium exploration. As the uranium market continues to strengthen, tied to ongoing concerns over future uranium supply, we believe that this market provides the right conditions for uranium exploration at the scale Stallion has planned for the coming year. As a team we are incredibly excited about what lies ahead in the coming months.”

Experienced Uranium Explorers

Speaking of the Stallion team, Stephen Stanley is a major investor in Stallion Discoveries and is an Advisor to the Board of Directors. Mr. Stanley was the President and CEO of Hathor Exploration which bought and developed the Roughrider Deposit in the Basin between 2006 and 2011, identifying an NI 43-101 compliant resource (indicated and inferred) of 57.94 million pounds of uranium. At the time, it was hailed as the third-highest graded uranium deposit in the world behind the McArthur River and Cigar Lake deposits.

In 2011, Hathor was acquired by Rio Tinto for about $550 million following a bidding war with Cameco. The project has not yet been developed, and Uranium Energy Corp. is now the owner with the intent to resurrect the project.

This is the roadmap Stallion Discoveries is following. Acquire land with uranium potential, explore and define the resource, sell to a major capable of further developing the project. Stallion’s uranium exploration is led by VP Exploration Canada Darren Slugoski, an Athabasca Basin veteran most recently involved with the discovery of the Spitfire deposit in the area.

What’s Next

These projects can take a while to develop, but there are opportunities for value creation all along the way. The upcoming drill program this fall/winter is an obvious place to start. Stallion recently revised a private placement financing upward from $2 million to $3 million due to high levels of investor interest. The financing utilizes in part Flow-Through Units that offer a strong tax incentive to investors as a result of the funds being used to cover eligible exploration expenses as defined in the Canadian Income Tax Act. The company’s uranium exploration also benefits from the 30% Critical Mineral Exploration Tax Credit. Look for news of the financing and the drill program to follow. With positive results from the fast-approaching exploration, there could be an upside opportunity for investors as Stallion Discoveries quantifies the uranium contained in its massive land package.