Lithium prices have experienced a rollercoaster ride over the past few years. In 2021, lithium carbonate prices rose from less than CNY100,000 per tonne to nearly CNY600,000 in late-2022 before falling back below CNY100,000 in late-2024. CNY100,000 is roughly equivalent to USD$14,000. There are several near-term catalysts that could help the market quickly recover.

In this article, we’ll look at three potential catalysts for the lithium industry and where investors might look to capitalize on a rebound.

Potential Lithium Catalysts in 2025

The United States and Europe have both imposed tariffs on EV imports from China. While these developments hurt exports and led to an oversupply, China has used a broad range of policy tools to domestically support its EV sector. New trade agreements or additional stimulus could provide a welcome boost and encourage battery makers to restock lithium.

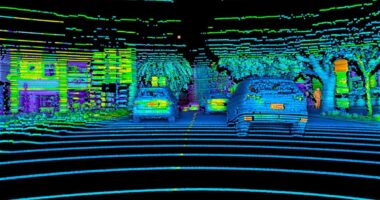

EV demand is higher than ever, but prices hit 2021-levels in recent months. Source: TradingEconomics

Additionally, President Trump’s promise to impose broad tariffs on all foreign products could spark a trade war. Historically, battery manufactures and other lithium customers respond to potential trade barriers by building inventory reserves to hedge against future supply chain disruption—activities that could increase demand for lithium and send prices higher.

And finally, the steep drop in lithium prices has led many hard rock mines in Australia and China to close, decrease production, or scale back their future investments. Recent examples include China’s CATL, the world’s largest battery maker, scaling back mine production that will result in an 8% decrease in the country’s lithium carbonate output. Meanwhile Pillbara Minerals, Australia’s largest lithium producer, is significantly curtailing mine production and suspending operations at one of its two ore processing plants. These developments could restrict future supply and lead to price improvements in 2025 and beyond.

Experts expect the lithium market to return to undersupply generally by the end of the decade. Analysts at FitchSolutions BMI expect the lithium carbonate price to rebound to USD$20,000/tonne in the next year or so, and the historic highs of nearly USD$80,000 reached in 2022 to not return for 5-10 years. Electric vehicle and electric battery companies need to forecast several years into the future to secure a supply of lithium, so investors would be wise to look at projects that could come online in the next few years. And those projects need to make economic sense around the USD$20,000/tonne price point.

In general, that means looking at lithium brine projects as opposed to the hard rock mining of spodumene or lepidolite deposits.

Where to Invest in the Market

Lithium South Development Corporation’s (TSX-V: LIS) (OTCQB: LISMF) Hombre Muerto North (HMN Li) project offers a unique opportunity. The project’s credentials are impressive: A proven 1,583,200 tons of high grade lithium carbonate equivalent resource, with 90% classified in the measured category – the gold standard for resource confidence. (Note 1)

With production targeted for 2029, the latest Preliminary Economic Assessment (PEA) outlines an operation producing 15,600 tons of lithium carbonate annually over a 25-year mine life. The numbers are striking: a post-tax Net Present Value of $934 million and a robust 31.6% Internal Rate of Return, using a lithium price of $20,000/tonne. (Note 2)

The company has already demonstrated its ability to produce lithium iron phosphate directly from its brine concentrate—a capability validated by an Argentine government agency that successfully manufactured an LFP battery using the material. This positions Lithium South to potentially capture more value from the growing LFP battery market.

The Bottom Line

While lithium prices have taken a beating over the past year, the fundamentals driving long-term demand remain strong. The shift toward LFP batteries continues to accelerate, EV adoption rates keep climbing, and supply constraints loom on the horizon. These factors suggest the current price weakness could present an opportunity for patient investors.

Companies like Lithium South (TSX-V: LIS) (OTCQB: LISMF), with advanced-stage projects and compelling economics, offer a way to potentially capitalize on the eventual market recovery. The company’s focus on low-cost brine extraction and its demonstrated ability to produce battery-grade materials position it well for when market conditions improve.

For more information, visit the company’s website or download the investor presentation.

Note 1: September 12, 2023 / National Instrument 43-101 resource calculated by Groundwater Insight Inc. (GWI) of Halifax, Nova Scotia, Canada, report SEDAR filed November 6, 2023 / Updated Mineral Resource Estimate – Hombre Muerto North Project, NI 43-101 Technical Report Catamarca and Salta, Argentina, Mark King, PhD, PGeo, Peter Ehren, M.Sc, MAusIMM, September 5th, 2023.

Note 2: News release March 1, 2024 The PEA was prepared by Knight Piésold Consulting (“KP”) and JDS Energy and Mining (“JDS”), both of Vancouver, in accordance with the standards set out in National Instrument 43-101 Standards of disclosure for Mineral Projects (“NI 43-101”), and CIM’s Best Practice Guidelines for Mineral Processing (“BPGMP”).

Disclaimer: TDM Financial is paid a fee of $ U.S. 10,000 per month by Lithium South Development Corp (LIS) for advertising consultation. TDM Financial produced this advertisement on behalf of LIS and as such it should be considered advertising. Nothing written in this advertisement is meant to facilitate a trade in the shares of LIS, and is not to be considered investment advice. This advertisement is published for information purposes only and the reader is encouraged to do his/her own due diligence regarding LIS.

This advertisement contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward-looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

Mr. William Feyerabend, a Consulting Geologist and Qualified Person under National Instrument 43-101, participated in the production of this advertisement and approves of the technical and scientific disclosure contained herein.