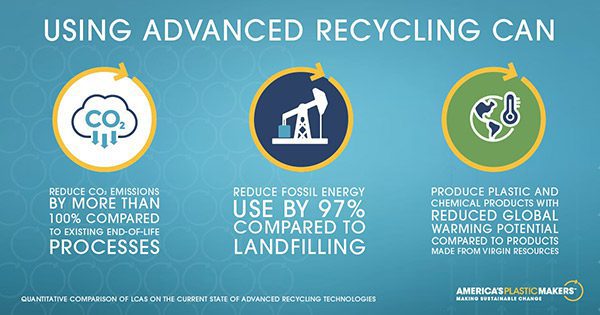

Investors are constantly on the lookout for the next big thing. It could be an industry in its infancy that is set for explosive growth, or it could be an existing industry that undergoes extreme changes that invite new, innovative players into the marketplace. All signs indicate that plastic recycling is a prime case of the latter instance. Plastic recycling is a massive market as it exists today, but only 10% of plastics are currently recycled utilizing existing technologies. That leaves a clear and pressing market opportunity for emerging technologies capable of recycling the remaining 90% of the global plastic industry.

This is no small opportunity. Every year plastic manufacturers produce about 430 million metric tons of new plastic, and despite the lip service paid to ‘Reduce, Reuse, Recycle’, about 390 million metric tons of it goes to waste in landfills, in our waterways, on our land, and in our neighborhoods. Current technologies require too much labor, too much sorting, and too much volume to be effective. Many plastic types simply cannot be recycled, and the ones that can cost too much or need to be transported too far or create too much pollution to make recycling viable.

In response to the overwhelming plastic waste problem, a Duke University study found that 72% of the world’s largest 300 companies are committed to reducing plastic waste and working toward a circular economy. Meanwhile, 175 countries are in the process of creating a legally binding agreement, through the UN Environment Programme, to end plastic pollution. The will is certainly there globally. The recycling technology to this point, however, is not quite up to the challenge.

With time running short and so much on the line, significant corporations from all industry sectors, from consumer product packagers to big oil companies, are partnering with and investing in smaller tech innovators seeking to advance plastic and hydrocarbon recycling technologies. Under the banner of Advanced Recycling Technologies, these innovations have the potential to drastically alter the plastics landscape.

Investors should be looking for opportunities in this nascent industry. The dynamics for a large breakout are in place. Global political, sociological, environmental, and economic forces drive the need to develop new solutions quickly. There are deadlines, from next year to 2030 or so, by which governments and corporations have committed to phasing out single use plastics and creating a more circular economy. There is investment flowing into the space from both public and private sources. And a few public company choices should be considered entry points for investors looking to capitalize. Petrochemical or consumer product giants often back these innovators to some extent as they look to make good on their goals of a circular plastic economy.

Procter & Gamble / PureCycle Technologies

Procter & Gamble, one of the world’s largest consumer packaged goods companies, developed a new technology that uses solvents to dissolve polypropylene plastic, remove contaminants, liquefy the remaining polymers, and produce plastic pellets for use in a wide range of products. PureCycle Technologies Inc. (NASDAQ: PCT) was created, in partnership with the tech commercializing firm Innventure, to bring the solution to market.

Polypropylene is known as plastic #5 in the packaging industry, but is also ubiquitous in items like clothing and carpets. Virtually none of it is recycled worldwide, and PureCycle is hoping to have 80 recycling operations worldwide by 2030. Getting there won’t be easy, as the full operation of its initial plant in Ironton, Ohio has been delayed for over two years after the technology was initially tested in a pilot plant. But the facility is now up and running, and the company is set to reach, by the end of the year, the important milestone of producing 4.45 million pounds of commercially viable ultra-pure recycled resin in a 30 day period.

Meanwhile, PureCycle is in the early stages (engineering, site planning, financing) of two other projects in the US and three more abroad. Considering the Ironton facility is anticipated to cost between $335 – $360 million before it hits commercial production, it could be a while before those projects come to fruition. PureCycle’s market cap is currently around $765 million in its pre-revenue phase.

Shell / Aduro Clean Technologies

Shell, the world’s second largest investor-owned oil and gas company, selected Aduro Clean Technologies, Inc. (CSE: ACT) (OTCQB: ACTHF) for participation in Shell GameChanger program. The program is designed to speed Aduro’s path to commercialization of its patented Hydrochemolytic™ technology, a water-based chemical process capable of recycling and upgrading almost any type of plastic. Aduro’s process is touted as a less expensive, more efficient, lower emission, and highly scalable solution compared to competing technologies.

Shell has promised investment of both non-dilutive money and expertise to help perfect and advance Aduro’s solution. For its part, Aduro has built its R2 Plastic Reactor, a pre-commercial customer engagement unit designed to demonstrate the technology and test the viability of various feedstocks. The program is set to wrap up by the end of 2023. Aduro also has agreements in place to build the next generation, an R3 unit on a small commercial scale. The company is at a similar stage of development in applying the same technology to the processing and upgrading of heavy crude oils into lighter more valuable oils.

In terms of plastic, Aduro’s system offers potential advantages over many competitors because it can work with a wide variety of plastic types, as opposed to focusing on just one or two. It also can be deployed on almost any scale from very small to very large, with significantly decreased capital expenditures compared to many of the other companies in the space. Additionally, the company is pursuing a licensing-based revenue model which lessens Aduro’s capital requirements. One interesting angle here is that Aduro thinks its technology can be complementary to almost any plastic recycling system out there. It can be added to a system mostly focused on one type of plastic to make that site more adaptable to different types of feedstock, for instance.

Aduro, like PureCycle, is pre-revenue, but maybe a bit behind PureCycle in approaching the commercial stage. The company is very active in its customer engagement program and recently announced the expansion of its relationship with a presently anonymous leading global petrochemical company. Aduro currently trades with a capitalization in the $55 million range.

Mitsubishi Chemical Group / Agilyx

One of Mitsubishi’s several core companies, Mitsubishi Chemical Group is an industrial materials and medical company focused on creating technologies that improve the lives of people and the well-being of the planet. The global giant is partnered with Agilyx (OTCQX: AGXXF) (OSE: AGLX) to develop and perfect a heat-based (pyrolysis) recycling solution for PMMA, or acrylic. The material is commonly used as a replacement for glass in windows, smartphone screens, and aquariums among other applications. Agilyx is also applying its process to the recycling of polystyrene, the material used in styrofoam.

At the same time, Agilyx has developed a joint venture with ExxonMobil, among other companies, called Cyclyx International. Cyclyx is focused on maximizing the recovery and sorting of plastic waste to provide feedstock for advanced recycling technologies.

Agilyx is just entering the revenue stage, with a commercial-scale polystyrene facility now operating in Oregon. The company is in the early planning stage of development, in conjunction with two other companies, for a second facility in Illinois. Meanwhile, the Toyo Styrene plant in Japan is expected to be commissioned at some point in Q1 2024. Agilyx reported revenue of about $16 million in FY 2022 in its early commercial phase, and currently trades with a market cap of about $196 million.

The Opportunity

If the world is to achieve a healthier, circular economy for plastic and reverse a decades-long trend of increasing plastic waste pollution, recycling technology must be upgraded and implemented at scale. The three companies discussed here have potential pieces of that technological solution and are in the early stages of development, boosted by investments from and partnerships with large multinational corporations looking to speed the market solutions. Public company investors may want to follow developments in the space as the pressure from large corporations and federal governments worldwide to implement solutions intensifies. The UN agreement contemplates a 2024 deadline to begin its initiatives, and many companies have been pointing toward 2025. Either way, the time is fast approaching, and there is more plastic than ever to be recycled.

image sources

- tanvi-sharma–4bD2p5zbdA-unsplash: Photo by tanvi sharma on Unsplash