Plastic waste is a global environmental and health issue. Plastic pollutes our waterways, makes its way into our bodies, and is found everywhere, from the ocean floor to the clouds. About 400 million tonnes of plastic is produced each year, and that number will hit 1.1 million tonnes by 2050 if current growth trends continue. Around the world, less than 10% of plastic is recycled, while the balance is incinerated, landfilled, or littered.

In addition to the pollution problem, consider the carbon emissions associated with the industry. With 98% of single-use plastic currently made from virgin fossil fuel stock, the level of greenhouse gas emissions associated with the production, use, and disposal of conventional fossil fuel-based plastics is forecast to grow to 19 percent of the global carbon budget by 2040. In response, countries and multinational corporations are desperately looking for ways to create a more circular economy for plastic and mitigate its negative impact around the world.

For example, the United Nations Environment Programme is in charge of finalizing an international plastics treaty by the end of 2024. The treaty takes a comprehensive approach that addresses the full life cycle of plastic, including its production, design, and disposal. The goal is to end, or in reality severely limit, pollution from plastic waste. 175 nations signed onto the agreement that set the treaty negotiation process in motion. The final negotiating session will take place in November in Busan, Republic of Korea, and a treaty is expected to be produced by the end of the year.

New Systems Required

Whatever comes of the treaty, there is a glaring need in the quest for a circular plastic economy for new, more efficient and diverse recycling technology. Mechanical recycling is currently the most prevalent form of plastic recycling, using grinding, washing, sorting, and reprocessing to repurpose plastic material. Effective sorting of the plastic types is crucial to mechanical recycling’s success, as only one type of plastic at a time can be recycled this way. Polyethylene terephthalate (PET) and high-density polyethylene (HDPE), the types of plastics that make up many beverage bottles and food containers, lend themselves to mechanical processing.

In response to the shortcomings of mechanical recycling, new technologies collectively known as ‘advanced’ or ‘chemical’ recycling have emerged. Rather than grinding down plastic into smaller bits of the same material, these technologies change the chemical structure of the plastic by breaking down long hydrocarbon chains into shorter ones. The result is a feedstock that can be made into new plastics or other chemical products.

Pyrolysis is the most common method of advanced recycling, utilizing very high heat to break the long chains. It is energy intensive, not super efficient, creates high emissions, and it still usually requires extensive sorting and cleaning. Pyrolysis, while the most common form of advanced recycling, is still not prevalent in the marketplace due to these limitations. It also works best on polyethylene and polypropylene, but not so well on the wider variety and volume of other plastics.

One emerging technology that shows perhaps the most promise is Hydrochemolytic™ Plastic Upgrading (HPU), developed by Aduro Clean Technologies, Inc. (CSE: ACT) (OTCQB: ACTHF) (FSE: 9D50). Aduro has been demonstrating HPU to potential customers, including global plastics producers, a food packing company, a plastic converter, and a building products manufacturer, in preparation for a full commercial rollout.

The potential customers are all multi-billion dollar companies that have non-disclosure agreements with Aduro to remain anonymous for now. The one exception is Shell. Aduro is in the final stages of participation in the Shell GameChanger program, designed to accelerate the development and commercialization of disruptive technologies like HPU.

The diversity and the size of Aduro’s potential client base raises a couple of questions. Within the vast world of plastics, what markets might be receptive to HPU? And, what do these companies see in HPU?

Large Market Segments

One of HPU’s main advantages over current technologies is its ability to process several different types of plastic with minimal sorting. So while mechanical recycling works fairly well for thoroughly sorted and cleaned PET and HDPE, it doesn’t work for other types of plastics. And while pyrolysis can handle some types of polyethylene and polypropylene, it too is limited to those types of plastics.

The plastic market is so large and diverse that there are significant opportunities within any one area of the industry, especially for an emerging technology offered by a company the size of Aduro, currently valued around $67 million. Consider PureCycle (Nasdaq: PCT), a company singularly focused on recycling polypropylene. PureCycle has one plant in Ohio that is capable of turning waste polypropylene into clean resin for resale. The plant has undergone difficulties and shutdowns while systems were refined, and last year was able to make about 200,000 pounds of pellets in the fourth quarter. This winter, PureCycle was able to increase production to about 1 million pounds in the first two months but has yet to sell its product.

PureCycle, not yet reporting revenue and entirely focused on one type of plastic, has a current valuation of about $965 million.

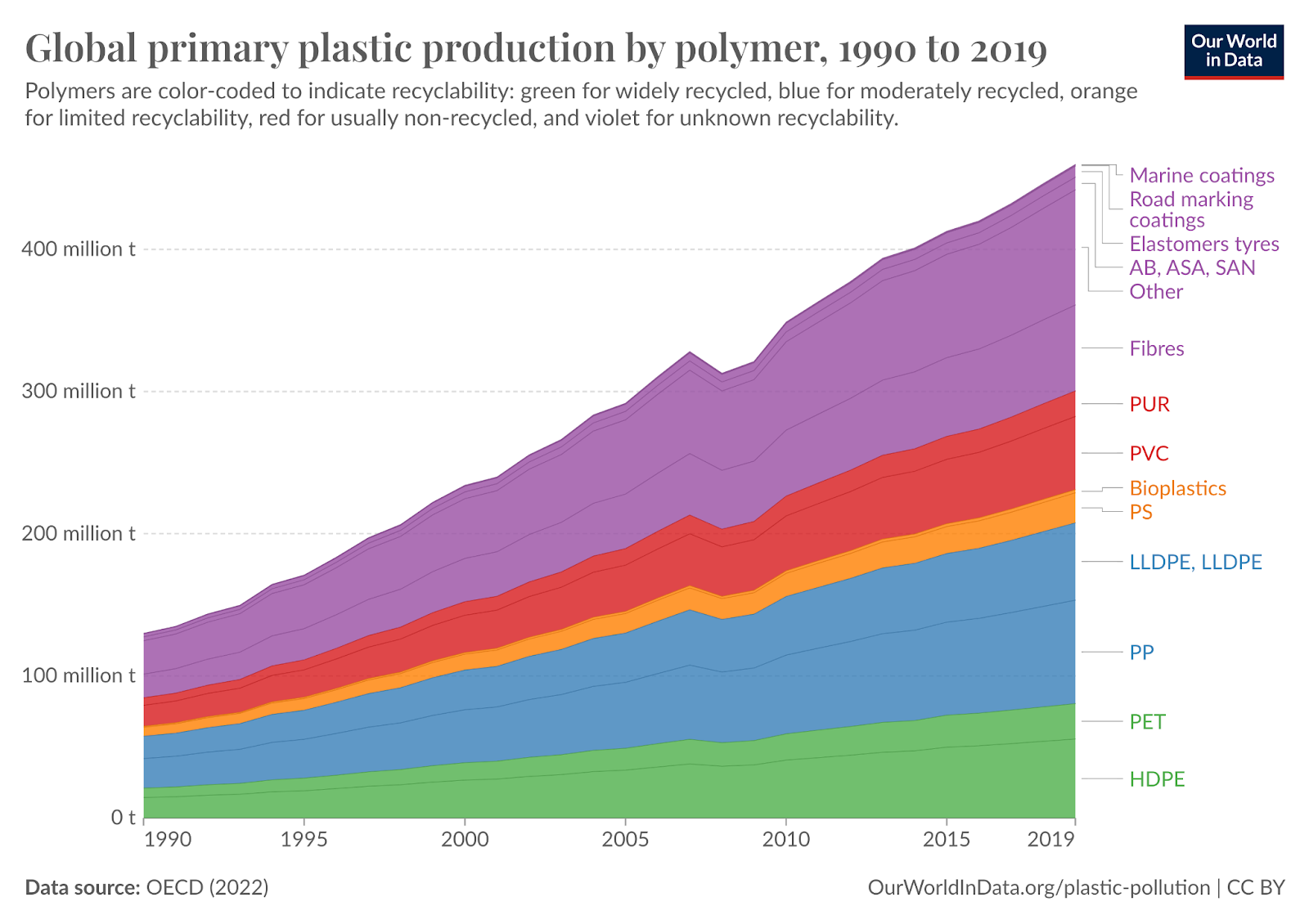

The above chart shows plastic production by type. The lower part of the blue section is PP, or polypropylene, the one type of plastic handled by PureCycle. The green section is the stuff currently recycled by mechanical means. According to the Organization for Economic Cooperation and Development, as of 2019 PET and HDPE (the green part of the graph above) together comprised about 17.5% of global plastic production. According to the EPA, in 2018 the United States recycled about 29% of each of these types of plastic. The rest of the plastic is either moderately recycled or effectively not recycled at all. These dynamics leave a gaping shortage in the quest to create a circular economy for plastic and a huge market opportunity for new technologies capable of handling more diverse types of plastics.

And that is exactly what HPU does. It was developed to handle various forms of polystyrene, polyethylene, and polypropylene. In the chart, that is about 50% of total production, from the orange PS section on down to the bottom. Or about 200 million tonnes of annual plastic production. HPU’s scalable technology is capable of efficiently processing all of these without much sorting or cleaning, and using less energy and creating significantly lower emissions than current technologies. And none of the current technologies can handle the variety of plastic types that HPU can.

Aduro recently shared incredibly efficient results from its polypropylene test runs, representing just a sampling of the testing the company has completed utilizing various feedstocks for its potential clients. 95% of the polypropylene was converted to highly saturated hydrocarbon feedstock that doesn’t require further processing to be used to form commercially viable second generation products. Only 5% went to waste, as carbon and fuel gas.

But Aduro’s HPU process may not even be limited to this 50% of total plastic production. There are other kinds of plastics that are intrinsic to industries including automotive, construction, wiring and cables, plumbing and more. These are called cross-linked polyethylenes (XLPE). The global market for them is estimated to be about $6 billion and is expected to double by 2032. XLPE is essentially not recyclable currently.

The building materials manufacturer mentioned earlier provided XLPE from its waste stream so Aduro could test its ability to recycle the materials. The results of the test were impressive.

Aduro was able to break down the complex polymers into broadly usable lighter hydrocarbons with up to 84% efficiency. These early results confirm the company’s general thesis that HPU can be used to effectively recycle a very wide range of plastic types. They also open the door for Aduro to target more industries than previously considered, including building materials, tire rubber, and elastomeric materials.

It remains to be seen whether HPU can process other types of plastic materials that have not been discussed here, covering the other 50% or so of the global plastic market. It seems to this point that Aduro hasn’t met a type of plastic it couldn’t handle.

What the Future Holds for Aduro

It is probable that Aduro will be announcing further test results and engagements with potential customers in the coming months as it gears up to build its commercial-scale pilot plant. Construction is expected to commence in Q4 2024 and likely to be completed by the end of 2025. We already know the process works very efficiently for a wide range of plastic types, something that no other current technology can claim. Proving the ability to operate at scale is one of the last remaining hurdles before commercialization of the system can begin in earnest. Keep an eye on Aduro, the little Canadian company set to disrupt a huge global industry.