The lithium market has had a bit of a rocky year, with the price of the metal crashing and stocks in the space lagging. The EV revolution, and the associated demand for lithium batteries, has been delayed somewhat as consumer demand hasn’t quite lived up to previous forecasts. Still, analysts remain focused on the long term trend that points to a supply shortfall in the next several years.

The market conditions now actually offer an opportunity for battery/vehicle makers and larger mining companies to acquire smaller miners or to secure future lithium supply through offtake agreements. Commenting on one major’s commitment to the lithium supply market, analyst Ben Isaacson at the Bank of Nova Scotia. In a report, he said: “Rio Tinto is in the business of cyclical commodities and understands the importance of not losing sight of mega-trends like we’re seeing in lithium.”

For investors in smaller miners with proven lithium resources, these dynamics should offer hope. Despite a stock market that has not been friendly to the industry, projects with the right characteristics are positioned to reward those investors with an exit that makes sense.

Interesting Project in Argentina

One company to keep an eye on in this regard is Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF). Lithium South is advancing its Hombre Muerto North Li (HMN Li) project in the heart of the Lithium Triangle in Argentina. HMN Li features a measured and indicated lithium carbonate equivalent resource of 1,583,200 tonnes, with 90% of the resource falling in the measured category, the highest resource classification available. (Note 1)

Lithium South commissioned a Preliminary Economic Assessment (PEA) to outline the potential for developing a mine on the site that would start production in 2029. The estimate is eye-opening for a company currently valued in the $15 million range. Utilizing an annual production rate of 15,600 tonnes of lithium carbonate annually, the PEA maps out a mine life of 25 years with a 2.5 year payback period. After tax, the project has a Net Present Value of $934 million resulting in a 31.6% Internal Rate of Return. All of the anticipated capital costs and operating expenses are figured into the results, and a market lithium price of $20,000/tonne is used in the calculation. (Note 2)

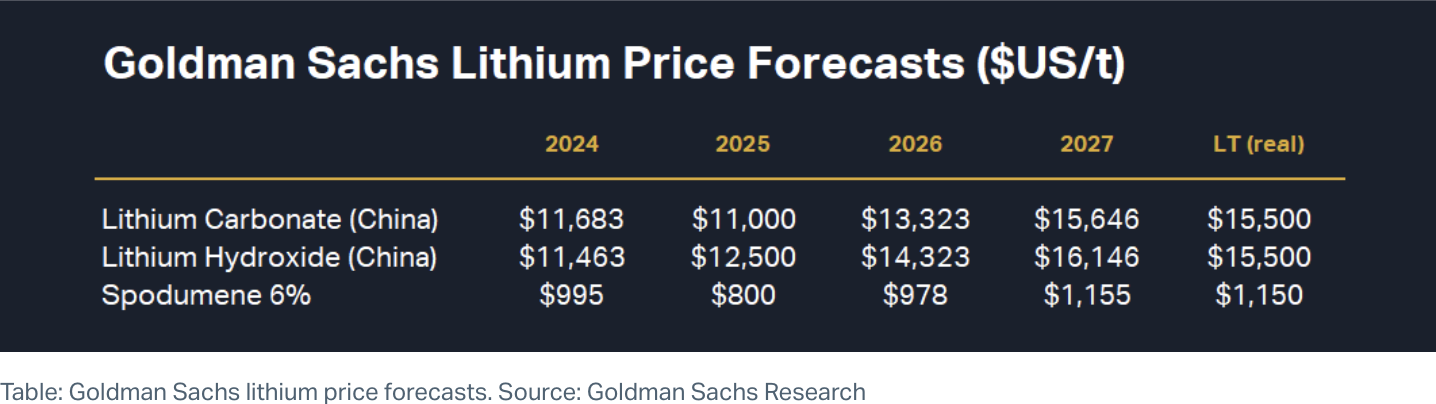

Today’s lithium price is more in the $11,000/tonne range after reaching highs of about $80,000/tonne in October, 2022. Goldman Sachs forecasts prices will rise back up into the $16,000/tonne range by 2027.

Now, Lithium South is moving through the process of completing an Environmental Baseline Study, a necessary precursor to securing approvals for the construction and operation of a mine on the site. Lithium South Founder, President, and Chief Executive Officer, Adrian F. C. Hobkirk comments, “We are now arriving at an important milestone for the HMN Li Project, the filing for construction permissions. The Company is moving this process ahead in conjunction with completing a Definitive Economic Assessment. During this process, the project may be further enhanced in throughput size, exceeding the 15,600 tonnes per year recently published in our Preliminary Economic Assessment. We look forward to completing the required engineering and well drilling on a fast-track basis.”

With Lithium South turning the page on HMN Li from an exploration project to a mine development project, it might be good to take a look at some recent lithium deals to assess the company’s potential.

Lithium Deals of Note

Ford Motor Company has signed four offtake agreements for supply of various forms of lithium. Two of these are with companies that are not yet in production. These deals are with Nemaska Lithium for 13,000 metric tonnes/year of lithium hydroxide, and with Compass Minerals for 4,400 metric tonnes/year of lithium carbonate. They complement deals with larger existing operations, and highlight Ford’s approach to cobble together a secure supply of lithium with companies of all sizes. Ford is focused on companies operating in countries with existing Free Trade Agreements with the United States to take advantage of incentives offered by the Inflation Reduction Act.

Very recently in Lithium South’s neighborhood, Australian miner Galan Lithium signed an MOU with Chengdu Chemphys Chemical Industry to purchase 23,000mt of lithium carbonate equivalent for an advance payment of $40 million. Galan’s Hombre Muerto West project is a little less than half constructed at this point, with production anticipated late in 2025. Interesting to note that Chemphys has a strategic relationship with Lithium South.

LG Energy Solution expanded its relationship with Australia’s Westfarmers Chemicals, Energy, and Fertilisers with a second offtake agreement. This one is for 85,000mt of lithium concentrate, which LG will turn into lithium hydroxide. The Australian project is expected to commence production in 2025. LG also has a supply deal in place with SQM in Chile.

SK On, a South Korean battery manufacturer, entered into a MOU with ExxonMobil for an offtake agreement covering up to 100,000mt of lithium from ExxonMobil’s project in Arkansas.

The Big Picture

The list goes on, but the pattern is clear. In today’s global economy, companies from around the world are striving to secure lithium supply wherever it can be found. In a lithium market that has suffered from generally negative sentiment recently, companies are still seeking opportunities to capitalize on the inevitable long-term trend of increased demand coupled with constricted supply.

According to S&P Global Commodity Insights, increased demand for battery capacity should be met through the year 2030 or so, but beyond that the supply of lithium from mining projects represents a bottleneck for the industry. According to the report: Indeed, while we calculate enough battery capacity to meet demand, the next step for the industry would be to focus on the supply chain upstream and address the expected shortages in more creative ways — by exploring new deposits in new geographies and developing new extracting and processing methods — to supply the lithium the world needs.

Companies around the world are looking far beyond the next five years to ensure adequate supply, and projects like Lithium South’s HMN Li sit squarely in the middle of those plans. Lithium South has made no secret of the company exploring avenues along these lines. Investors should take note, as any deal is likely to have a significant impact on the company and its ~$16 million valuation.

Note 1: September 12, 2023 / National Instrument 43-101 resource calculated by Groundwater Insight Inc. (GWI) of Halifax, Nova Scotia, Canada, report SEDAR filed November 6, 2023 / Updated Mineral Resource Estimate – Hombre Muerto North Project, NI 43-101 Technical Report Catamarca and Salta, Argentina, Mark King, PhD, PGeo, Peter Ehren, M.Sc, MAusIMM, September 5th, 2023.

Note 2: News release March 1, 2024 The PEA was prepared by Knight Piésold Consulting (“KP”) and JDS Energy and Mining (“JDS”), both of Vancouver, in accordance with the standards set out in National Instrument 43-101 Standards of disclosure for Mineral Projects (“NI 43-101”), and CIM’s Best Practice Guidelines for Mineral Processing (“BPGMP”).

Disclaimer: TDM Financial is paid a fee of $ U.S. 10,000 per month by Lithium South Development Corp (LIS) for advertising consultation. TDM Financial produced this advertisement on behalf of LIS and as such it should be considered advertising. Nothing written in this advertisement is meant to facilitate a trade in the shares of LIS, and is not to be considered investment advice. This advertisement is published for information purposes only and the reader is encouraged to do his/her own due diligence regarding LIS.

This advertisement contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward-looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

Mr. William Feyerabend, a Consulting Geologist and Qualified Person under National Instrument 43-101, participated in the production of this advertisement and approves of the technical and scientific disclosure contained herein.