Pyrolysis, a chemical recycling technology that breaks down plastic waste through high-temperature processing in oxygen-free environments, has emerged as a contentious solution to the global plastic crisis. While proponents highlight its potential to divert non-recyclable plastics from landfills and reduce dependence on fossil fuels, critics raise concerns about efficiency, environmental impact, and scalability.

Almost all advanced recycling solutions, whether currently on the market or in development, utilize pyrolysis. But there is one emerging company, Aduro Clean Technologies, Inc. (Nasdaq: ADUR) (CSE: ACT) (FSE: 9D5), which is developing an intriguing alternative. Aduro’s potential solution is a water-based chemical recycling platform called Hydrochemolytic™ technology, or HCT.

Here we’ll take a look at the two technologies and compare their potential to bring the goal of a circular economy for plastics closer to reality.

Industry Overview

For a very long time, a physical or mechanical recycling process has been the norm. This involves extensive washing, sorting, grinding, and melting to create a homogenous plastic recyclate that can then be used to make more plastic products. The system is inefficient, largely due to the intense sorting and pre-processing needed and to the inadequacy and inconsistency of the recyclate product.

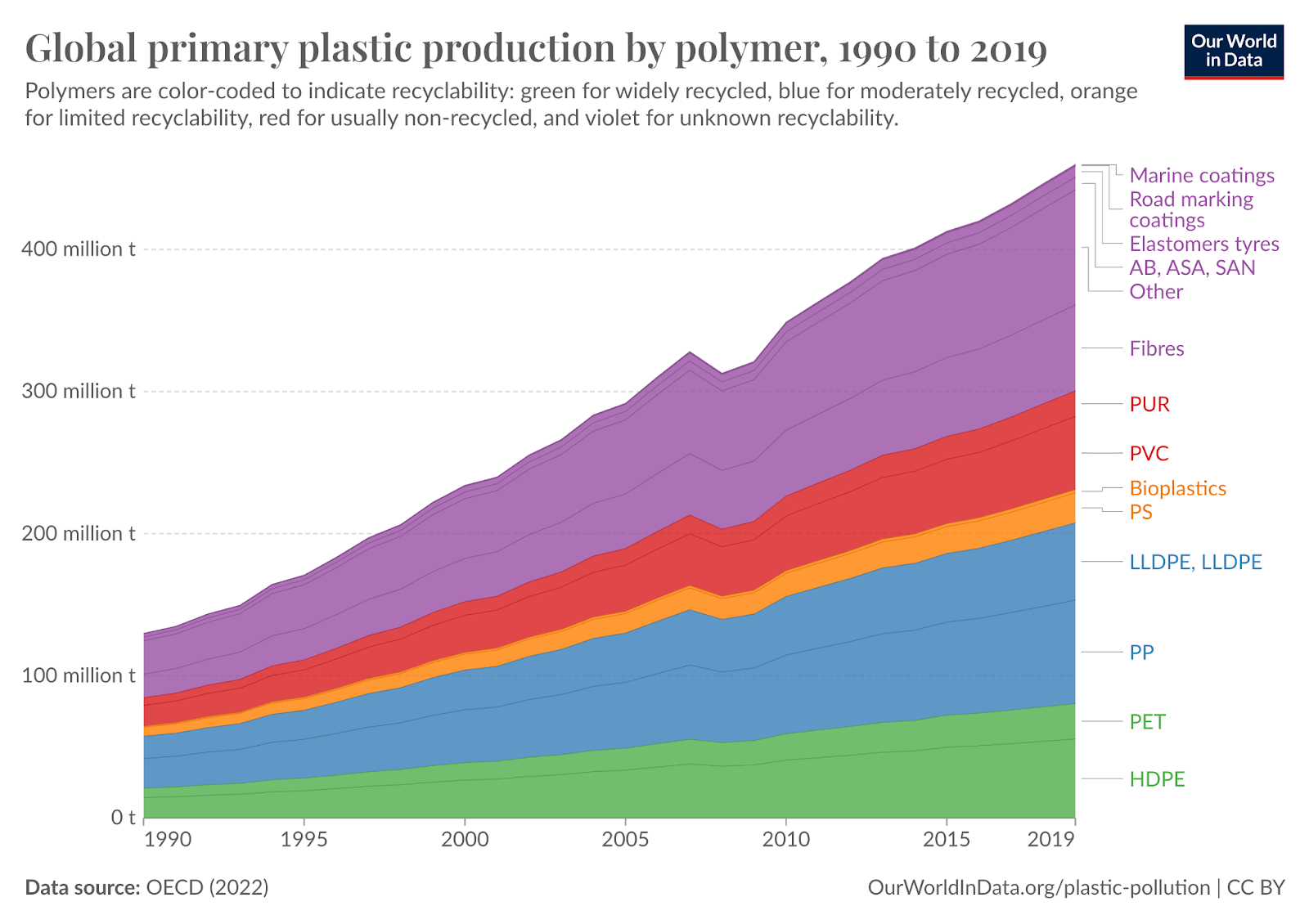

The dominance of mechanical recycling basically got us where we are today, with only 9% of the more than 400 million tonnes of annual global waste plastic actually being recycled. In essence, mechanical recycling is limited to very clean and highly sorted feedstock consisting of clear polyethylene terephthalate (PET, think beverage bottles) and high density polyethylene (HDPE, think milk bottles). Together these categories constitute about 20% of global plastic production, the green section in the graphic below.

Remember that not all of that 20% can be effectively recycled mechanically. It needs to be sorted and cleaned to a high degree, and the PET is best recycled if it is clear rather than colored.

Pyrolysis

Pyrolysis involves the application of intense heat, in the 400-700° Celsius range to break down plastic into its molecular components. The desired output is pyrolysis oil, which can be refined and used as fuel or as a feedstock for producing new plastics and chemicals.

According to a study conducted by the United States Department of Energy’s Argonne National Laboratory, pyrolysis can greatly reduce greenhouse gas emissions and the use of fossil fuels in the production of HDPE and Low Density Polyethylene (LDPE) when compared to the virgin plastic process. Those were the only types of plastics included in the study, and they also happen to overlap to some extent the types of plastics that can be mechanically recycled.

Even those conclusions are widely questioned. A more recent study found that even in the best case scenario, only 2% of the plastic waste fed into pyrolysis will actually make it into a recycled product. Basically, pyrolysis oil requires significant dilution with virgin petroleum naphtha and multiple energy-intensive purification steps to create consumer-quality end products.

Reuters took a look at 30 projects around the world and found failure after failure. Most of the projects examined by Reuters use pyrolysis as the catalyst for the recycling process. Pyrolysis projects have been proposed and scrapped over the past 20 years due to technical and commercial limitations.

Shell had a stated goal of processing 1 million tonnes of plastic waste annually by 2025 via pyrolysis, but in its 2023 Sustainability Report the company retracted. “While Shell sees customer demand for circular chemicals, the pace of growth globally is less than expected due to lack of available feedstock, slow technology development and regulatory uncertainty. As a result, in 2023 we concluded that the scale of our ambition to turn 1 million tonnes of plastic waste a year into pyrolysis oil by 2025 is unfeasible.”

The overall picture for pyrolysis is that it is likely preferable to mechanical recycling and/or just giving up and incinerating or landfilling waste plastics, but it is by no means a solution that is capable of creating an actual circular economy for plastics.

HCT™

Perhaps spurred by the limitations encountered in its pyrolysis project, Shell selected Aduro for participation in the Shell GameChanger program. The program is designed to speed Aduro’s path to commercialization of its patented Hydrochemolytic™ technology, a water-based chemical process capable of recycling and upgrading almost any type of plastic. Aduro’s process is touted as a less expensive, more efficient, lower emission, and highly scalable solution compared to competing technologies.

The Between Chemistry in Action: A Process Flow Illustration of Aduro’s HPU Technology

Aduro’s system offers potential advantages over many competitors because it can work with a wide variety of plastic types as opposed to focusing on just one or two. Aduro has shown it can efficiently recycle polypropylene, polystyrene, and polyethylene – these types of plastic represent about 70% of the plastic currently entering municipal waste systems in the United States.

HCT™ operates in the 350-400° C range, substantially lower than pyrolysis, so it requires less energy. It is also highly efficient. Aduro shared incredibly efficient results from its polypropylene test runs, representing just a sampling of the testing the company has completed utilizing various feedstocks for its potential clients. 95% of the polypropylene was converted to highly saturated hydrocarbon feedstock that doesn’t require further processing to be used to form commercially viable second generation products. Only 5% went to waste, as carbon and fuel gas.

The Investment Opportunity

Aduro, trading with a valuation around $125 million, has a diverse and efficient solution to a multi-billion dollar problem. Aduro’s strategy is to license its technology to industry partners rather than build and operate recycling plants itself. This capital-light model allows for rapid expansion, recurring revenue streams, and high margins. The company is scheduled to complete a pilot plant Q3 2025. This facility will validate the technology at industrial scale and generate critical data for commercial deployment.

The $1.2 billion+ market cap PureCycle Technologies, Inc. (NASDAQ: PCT) is a good indication of the potential in the space. PureCycle is focused on building its own large facilities to process one type of plastic, polypropylene. The company is probably one or two years ahead of Aduro’s timeline and is hopeful of achieving meaningful revenue this year from its first plant.

Meanwhile, Aduro can recycle polypropylene, polyethylene, and polystyrene as well as other varieties of plastic. It’s safe to say there is plenty of upside for Aduro. When you hear about advanced recycling and its ability to solve the world’s plastic waste problem, keep in mind Hydrochemolytic™ technology and the advantages it offers.

image sources

- tanvi-sharma–4bD2p5zbdA-unsplash: Photo by tanvi sharma on Unsplash