Collaboration, Investment Driving Innovation

A report from McKinsey & Company details the progress toward creating a circular economy for plastics, and the significant obstacles that stand in the way of achieving that goal. The positives include commitments from countries and large companies around the world to boost plastic recycling far beyond the current woefully inadequate levels, and the potential for advanced recycling technologies to greatly speed the necessary improvements. The negatives include the need for significant investment throughout the industry to even approach the goals, and the complex partnerships across the advanced recycling value chain necessary to achieve scalability.

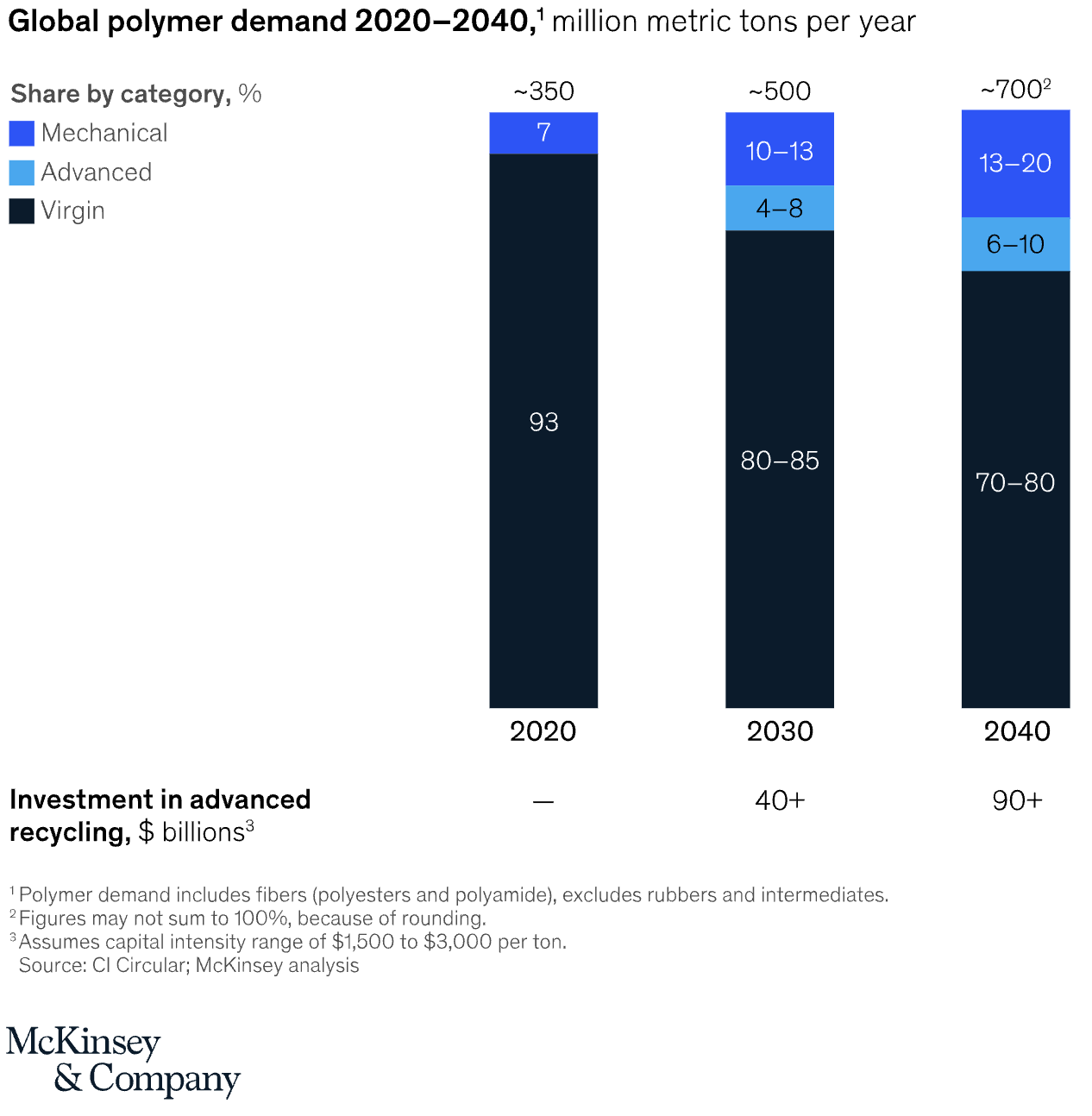

At the current pace of investment, regulation, and corporate commitment, McKinsey estimates that with about $40 billion of investment advanced recycling can supply anywhere from 20 to 40 million metric tons of plastic annually, or about 4-8% of the global plastics supply, by 2030.

There is an investment opportunity here. If large companies are pouring money into younger technology upstarts, investors may want to pay attention to the smaller companies with plenty of headroom. Some examples include Procter & Gamble investing in PureCycle Technologies (NASDAQ: PCT) for the recycling of polypropylene; Mitsubishi partnering with Agilyx (OTCQX: AGXXF) (OSE: AGLX) for the recycling of acrylic; and ExxonMobil’s joint venture with Agilyx (called Cyclyx International) to improve recovery and sorting of plastic waste to provide feedstock for advanced recycling technologies. There are other private companies pushing the industry forward as well.

Aduro and Shell

One interesting company to watch is Aduro Clean Technologies, Inc. (CSE: ACT) (OTCQB: ACTHF). Aduro is currently about halfway through its initial partnership with Shell as part of the company’s Shell GameChanger program. The program is designed to speed Aduro’s path to commercialization of its patented Hydrochemolytic™ technology (HCT), a water-based chemical process capable of recycling and upgrading almost any type of plastic. Aduro’s process is touted as a less expensive, more efficient, lower emission, and highly scalable solution compared to competing technologies.

Shell has promised investment of both money and expertise to help perfect and advance Aduro’s solution. To date there has been no formal announcement of an investment, but the two companies have completed 3 of the 6 phases of the program. This particular engagement is focused on turning waste polyethylene and polypropylene into Naptha Cracker feedstock for the production of second-generation plastics.

Polyethylene global production is estimated at 110 million tonnes/year, and polypropylene comes in around 74 million tonnes/year. Together, they constitute a little less than half of global plastic production. This is the market being addressed in particular via the Shell/Aduro collaboration. Keep in mind that Aduro believes it is capable of treating almost any type of existing plastic.

For its part, Aduro has built its R2 Plastic Reactor, a pre-commercial customer engagement unit designed to demonstrate the technology and test the viability of various feedstocks. Aduro also has agreements in place to build the next generation, an R3 unit on a small commercial scale. The final phase of the Shell GameChanger program is expected to be completed by the end of the year.

The program provides non-dilutive funding and technical expertise to help Aduro develop reliable process designs and optimize the HCT technology for commercial implementation. The program also mentors Aduro in developing its commercial strategy and market position. This is just the sort of boost Aduro could use as it enters the commercial phase of its development.

Where It’s Headed

For Shell and Aduro, this initial program is slated to end later this year. Currently there is no telling if the relationship will continue into the future, but the goal of the whole project is to speed Aduro’s full commercial launch while maximizing the efficiency of its technology. If Aduro is able to launch in the near term, the upside for the ~$50 million market cap company could be significant. In comparison to other companies in the space, most of which are focused on recycling just one type of plastic, Aduro’s ability to process a wide variety of plastics means it has a much larger potential market. The coming quarters will show whether the company can execute.

image sources

- tanvi-sharma–4bD2p5zbdA-unsplash: Photo by tanvi sharma on Unsplash