VANCOUVER, British Columbia, June 03, 2024 (GLOBE NEWSWIRE) — Stallion Uranium Corp. (the “Company” or “Stallion”) (TSX-V: STUD; OTCQB: STLNF; FSE: HM40) is pleased to announce that, further to its news release dated February 13, 2024, the Company has closed the purchase and sale agreement dated February 12, 2024 (the “Agreement”), under which the Company has sold Glorious Creation Limited (“Glorious”) 100% interest in its three Eastern Basin Projects, comprising seven (7) mineral claims totalling approximately 10,874 hectares (26,870 acres) located in the Province of Saskatchewan (the “Property”).

” All three projects are located in the heart of the world-renowned Eastern Athabasca Basin and hold potential for a high-grade discovery. The closing of this sale will bring exploration programs to these projects, and Stallion is aligned to benefit from that exploration success,” stated Drew Zimmerman CEO. “Our technical and geological team will be working with Glorious to manage the exploration efforts, but the sale allows for Stallion to remain focused on our targets in the southwestern Athabasca Basin, including our Appaloosa target that saw great success on our maiden drill program, moving the company towards a discovery.”

Pursuant to the Agreement, Glorious shall acquire a 100% interest in the Property for the following consideration to the Company:

- concurrently with the signing the Agreement, a cash payment of $100,000.00 (the “Deposit”), which one half of the Deposit ($50,000) will be refundable by the Company to Glorious should Glorious does not obtain approval from the Canadian Securities Exchange (“CSE”);

- on the date of the Closing (the “Closing Date”), a cash payment of $300,000;

- an aggregate of 2,500,000 common shares of Glorious (each, a “Share”) to be issued to the Company as follows:

- 500,000 Shares on the date which is six (6) months following the Closing Date,

- 500,000 Shares on the date which is twelve (12) months following the Closing Date,

- 500,000 Shares on the date which is eighteen (18) months following the Closing Date, and

- 1,000,000 Shares on the date which is twenty-four (24) months following the Closing Date.

The Company shall retain a royalty of three percent (3%) of net smelter returns from minerals mined and removed from the Property, of which Glorious may purchase up to one and one-half percent (1.5%) at any time prior to commercial production on the Property as follows: $500,000 for one-half percent (0.5%); $750,000 for an additional one-half percent (0.5%); and $1,000,000 for an additional one-half percent (0.5%).

The Company and Glorious have also entered into an operating agreement (the “Operating Agreement”) pursuant to which Stallion will conduct an agreed upon exploration program on one or more of the Properties for an operating fee.

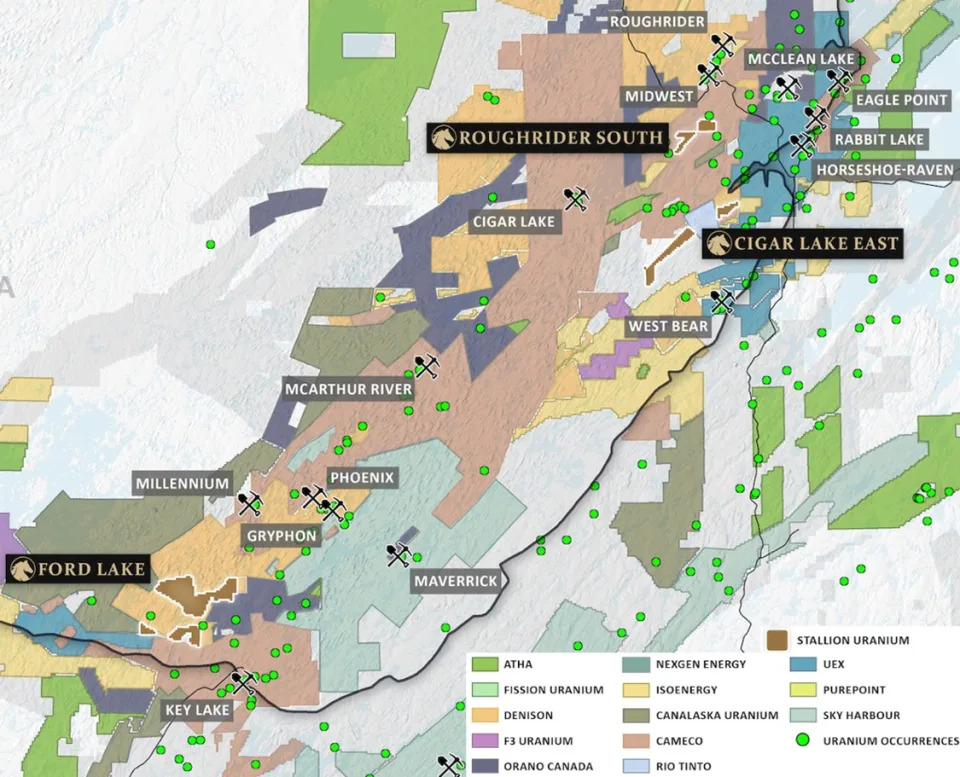

The projects are located in the Eastern Athabasca Basin with the Wollaston and Mudjatik Supergroups. The region has been the focus of uranium exploration over the last 50 years and is host to the world class Cigar Lake and McArthur River Uranium Deposits which together host over 550M pounds of uranium. Uranium mineralization in the Eastern Athabasca Basin occurs in three deposit types: 1) unconformity-hosted uranium which occur at the contact between the overlying Athabasca Basin and the crystalline basement rocks; 2) basement-hosted uranium which occur within the basement rocks; 3) sandstone-hosted uranium which occur perched in the Athabasca sandstone. The projects have the potential to host all three uranium deposit types. Given that uranium mineralization is structurally controlled, the company will be utilizing the recently completed magnetic and electromagnetic survey data to identify structural areas for advanced exploration.

Additionally, the Company has engaged Knox Communications Inc. (“Knox”) to provide investor relations services for a period of six (6) months commencing June 1, 2024, for a consideration of $4,000 CAD per month and renewing for additional one-month terms unless terminated by either party, pursuant to an agreement dated May 31, 2024. The Company has granted 200,000 stock options, exercisable at $0.10 expiring on May 31, 2029 to Knox pursuant to the agreement. The stock options are issued pursuant to the Company’s share option plan and are subject to vesting conditions. Knox does not currently own any interest, directly or indirectly, in the Company or its securities.

Qualifying Statement:

The foregoing scientific and technical disclosures for Stallion Uranium have been reviewed by Darren Slugoski, P.Geo., VP Exploration, a registered member of the Professional Engineers and Geoscientists of Saskatchewan. Mr. Slugoski is a Qualified Person as defined by National Instrument 43-101.

About Stallion Uranium

Stallion Uranium is working to Fuel the Future with Uranium through the exploration of over 3,000 sq/km in the Athabasca Basin, home to the largest high-grade uranium deposits in the world. The company, with JV partner Atha Energy (TSX-V:SASK), holds the largest contiguous project in the Western Athabasca Basin adjacent to multiple high-grade discovery zones.

Our leadership and advisory teams are comprised of uranium and precious metals exploration experts with the capital markets experience and the technical talent for acquiring and exploring early-stage properties.

Stallion offers optionality with two gold projects in Idaho and Nevada that neighbour world class gold deposits offering exposure to upside potential from district advancement with limited capital expenditures.

For more information visit stallionuranium.com or contact:

Drew Zimmerman

Chief Executive Officer

778-686-0973

info@stallionuranium.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”) that relate to the Company’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this material change report should not be unduly relied upon. These statements speak only as of the date they are made.

Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for the Company to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this presentation are expressly qualified in their entirety by this cautionary statement.