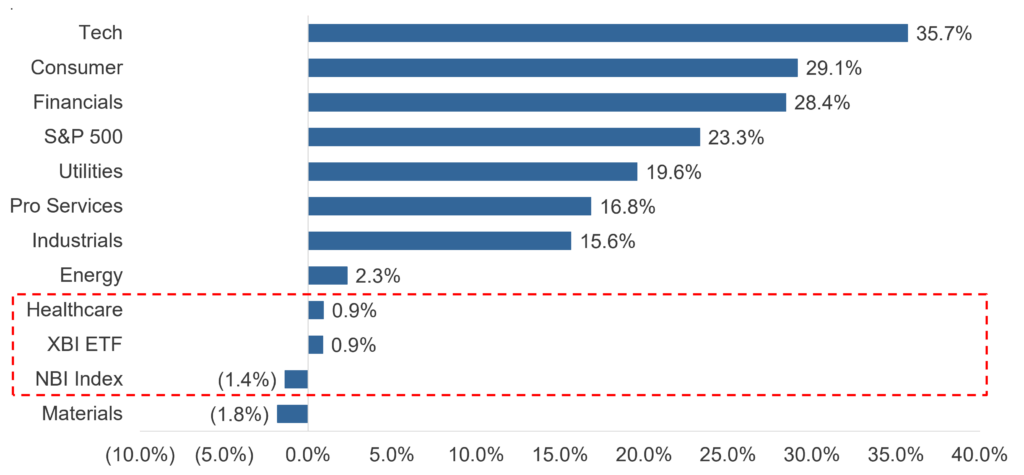

While the stock market broadly experienced significant gains in 2024, a few sectors lagged for a variety of reasons. Healthcare was one of those industries, experiencing less than one percent growth overall compared to much larger gains for many other sectors and for the major indexes as a whole. The S&P 500 rose 23.3% and the Nasdaq rose 28.6%. Meanwhile, the Nasdaq Biotechnology Index (NBI) lost 1.4% and the SPDR S&P Biotech ETF (XBI) gained 0.9% on the year.

2024 Sector Performance

Source: Mizuho Americas Healthcare

Still, there were several companies that experienced major gains in 2024, and investors would be wise to keep an eye on them in the new year. Here we’ll take a look at three of them, each with the potential for sustained growth due to potential catalysts in 2025: Stoke Therapeutics, Inc. (Nasdaq: STOK), Cardiol Therapeutics Inc. (Nasdaq: CRDL) (TSX: CRDL), and Tarsus Pharmaceuticals, Inc. (Nasdaq: TARS).

Stoke Therapeutics

Stoke Therapeutics is a clinical-stage company focused on deploying RNA medicine to restore protein deficiencies that cause a variety of disease conditions. Stoke’s most advanced candidate, zorevunersen, is being investigated for the treatment of Dravet syndrome. Dravet syndrome is a rare but severe genetic form of epilepsy that affects about 1 in 16,000 infants and gets progressively worse over time.

The company was granted Breakthrough Therapy Designation by the U.S. Food and Drug Administration (FDA) in December following positive Phase 1/2 trial results. The designation is designed to fast-track development of drugs that show the potential to substantially improve outcomes for patients with serious conditions. Stoke plans to start a pivotal Phase 3 trial in mid-2025. The company believes zorevunersen has the potential to be the first disease-modifying medicine for the treatment of Dravet syndrome. The company’s other drug candidates are in preclinical development.

Stoke’s stock began 2024 at $5.16/share and ended the year trading at $11.03/share, a gain of about +114%. The company is currently valued at approximately $562 million. (All figures in US dollars unless otherwise noted.)

Cardiol Therapeutics

Cardiol Therapeutics is a clinical-stage company focused on developing anti-inflammatory and anti-fibrotic therapies for the treatment of heart disease. Cardiol is in the process of launching a Phase 3 trial for its most advanced program, testing its lead drug candidate CardiolRx™ for the treatment of recurrent pericarditis. Pericarditis is the inflammation of the membrane surrounding the heart, causing debilitating chest pain, shortness of breath, emergency room visits, and hospitalization. While many cases resolve over time, multiple recurring episodes of pericarditis can last anywhere from one to five or more years. Recurrent pericarditis affects around 38,000 Americans annually.

Cardiol’s recurrent pericarditis program is operating under the FDA’s Orphan Drug Designation (ODD), designed to encourage development of therapies for rare diseases. The ODD offers fast track development and market exclusivity among other benefits for participating companies. Cardiol is also in the late stages of a Phase 2 trial testing CardiolRx™ for the treatment of acute myocarditis. Acute myocarditis is another burdening rare heart condition in young adults and a leading cause of sudden cardiac death in people less than 35 years of age. Importantly, there is no current approved treatment for acute myocarditis, and a new therapy would qualify for the ODD.

Cardiol’s stock opened 2024 at $0.82/share and closed the year at $1.28/share, representing a +56% increase. The share price reached a high of $2.97 in the summer. The company currently has a market capitalization of about $119 million.

Tarsus Pharmaceuticals

Tarsus Pharmaceuticals is developing treatments for a variety of eye conditions and infectious diseases like lyme disease. Tarsus currently markets XDEMVY®, an eye drop that treats Demodex blepharitis, in the United States. Demodex blepharitis affects millions of Americans but is often underdiagnosed. Symptoms include red and itchy eyelids, crusty discharge, and sensitivity to light. The drug was approved in July 2023 and commercially launched in August, but sales really took hold in 2024. Tarsus reports $113.7 million in sales for the first nine months of 2024, compared to $14.7 million in the final months of 2023 following the launch.

The company recently announced plans to accelerate the launch of XDEMVY® with an expanded sales force and a direct-to-consumer advertising campaign. Meanwhile, Tarsus is planning to initiate a Phase 2 study, in the second half of 2025, of a topical gel for the treatment of ocular rosacea, another troubling and largely untreated eye condition.

Tarsus’ stock began last year trading at $20/share and closed 2024 with a share price of $55.37. That is a gain of about +177% on the year. Tarsus is currently valued around $1.86 billion.

What 2025 Holds

Last year started out looking like a year of major growth in the biotech industry, but ended with a bit of a fizzle. Still, these companies fought the headwinds to produce strong returns based on solid trial results and/or major revenue growth. All of them have major growth potential in 2025 should they deliver on their plans for the year. Keep an eye on these companies as the year unfolds and their progress continues.