LEEF Brands Inc. (CSE: LEEF) (OTCQB: LEEEF) is one of California’s leading cannabis extraction companies, providing high-quality extracts for many of the biggest brands in the world’s largest legal cannabis market. LEEF currently buys raw cannabis stock from over 200 California growers to feed its extraction operations. However, that is all set to change over the next two to three years as the company expands what will become one of the world’s largest legal outdoor cannabis farms.

Planting the Ranch

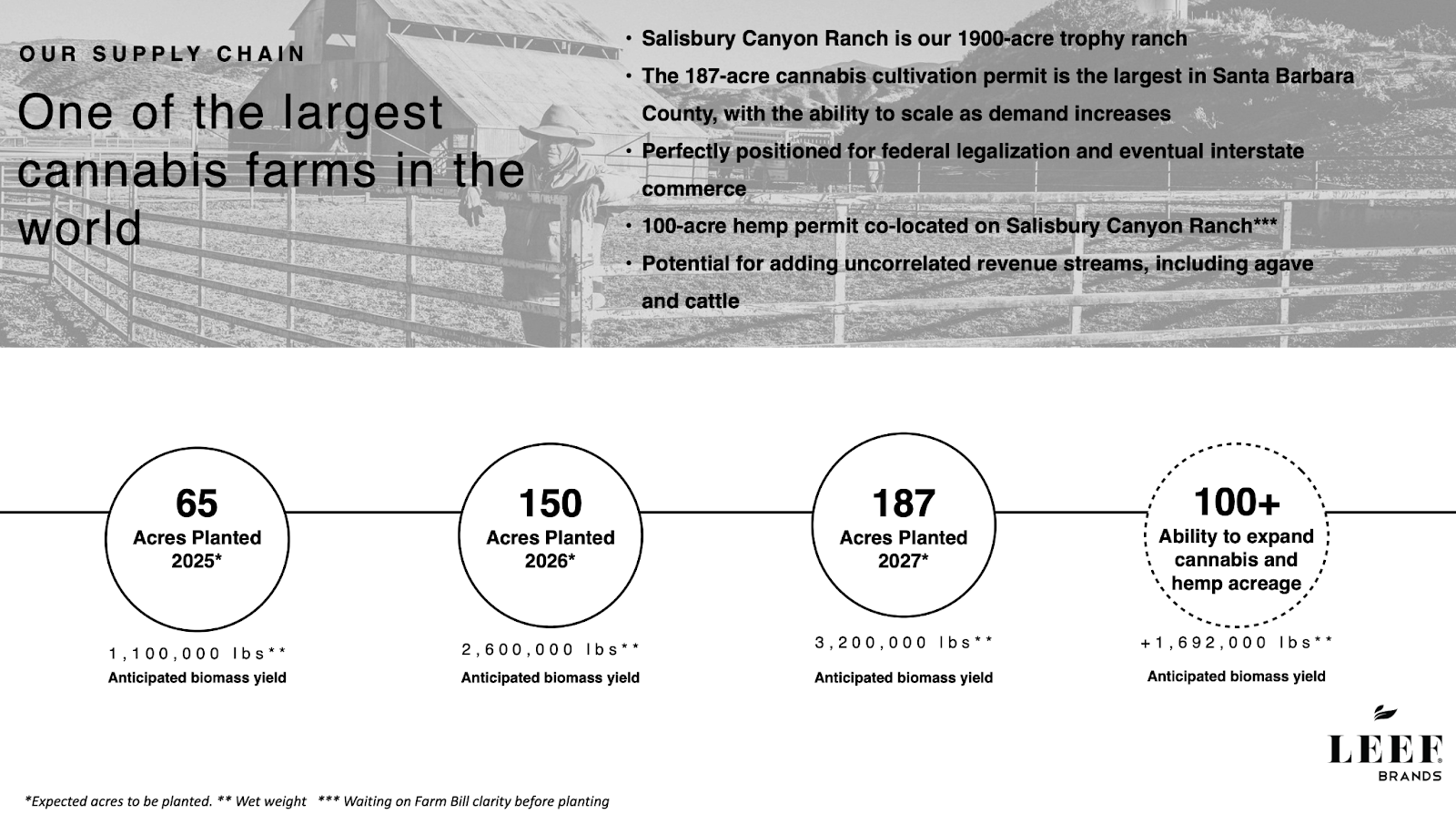

LEEF owns the Salisbury Canyon Ranch in Santa Barbara County and has recently planted the first 65 acres out of a total of 187 plantable acres. The move to create its supply chain aims to reduce material costs, improve margins, supplement, and even replace current supply sources while ensuring the highest quality throughout the operation.

Impact on Profitability

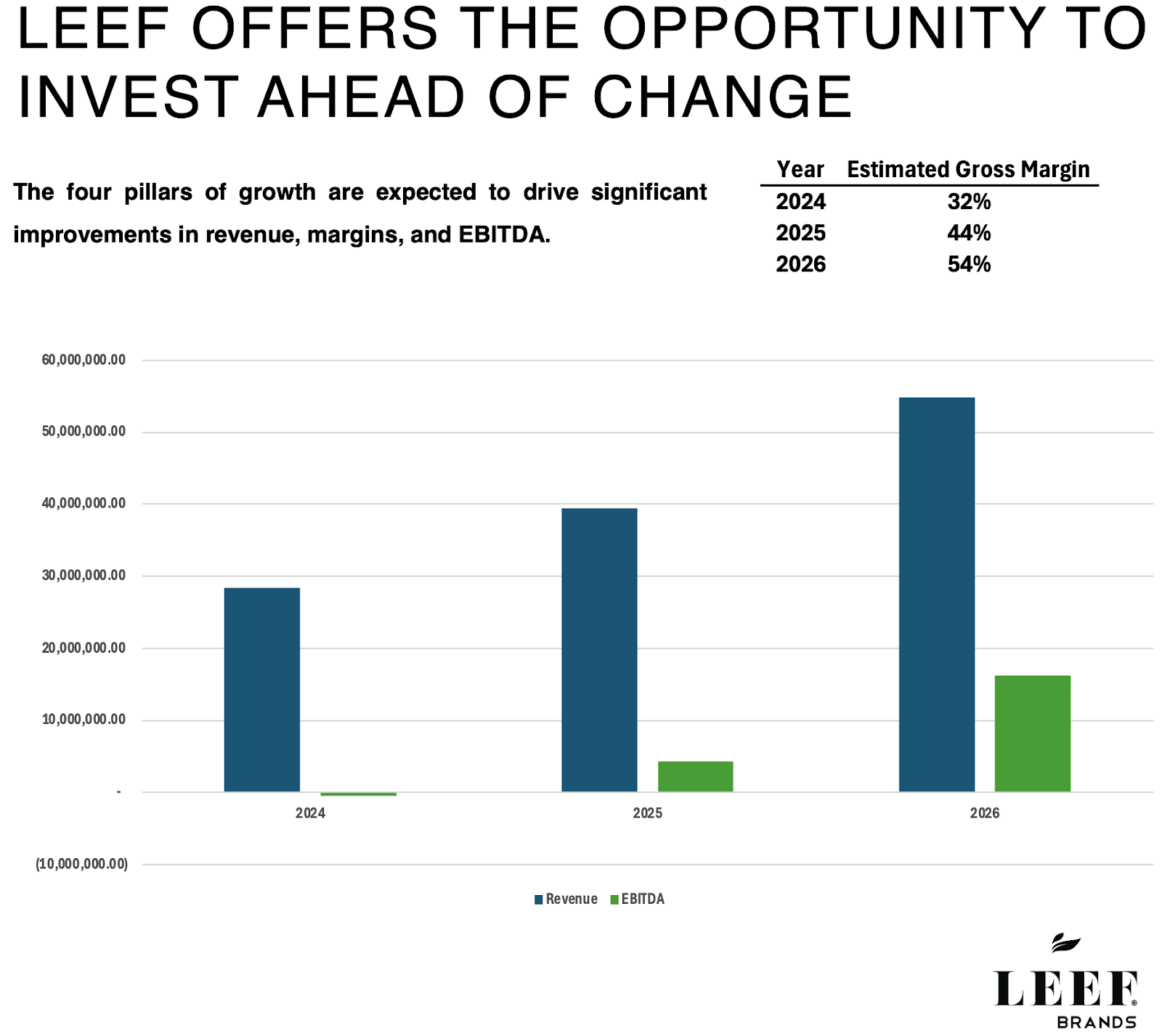

LEEF is teetering on becoming cash flow positive. After years of purchasing and improving the ranch property at significant cost, the plan to create one of the world’s largest outdoor cannabis farms is becoming a reality. LEEF estimates that the move to vertically integrate its own supply of feedstock could cut material costs anywhere from 40% to 65% depending on the type of material. This would obviously have a tremendous impact on the company’s profitability moving forward.

Source: LEEF Brands Investor Presentation

More Room for Expansion

LEEF’s full-scale production capacity in California now allows the company to process about 3.1 million pounds of raw cannabis material annually. By 2027, the company will have fully planted and grown approximately 3.2 million pounds annually across all 187 acres, with each strain optimized for its extraction characteristics. LEEF also can significantly expand production capacity at its current location with minimal capital investment.

Source: LEEF Brands Investor Presentation

The Salisbury Canyon Ranch is also permitted for 100 acres of hemp production, and the company is waiting on regulatory clarity from the federal government before diving into the hemp market.

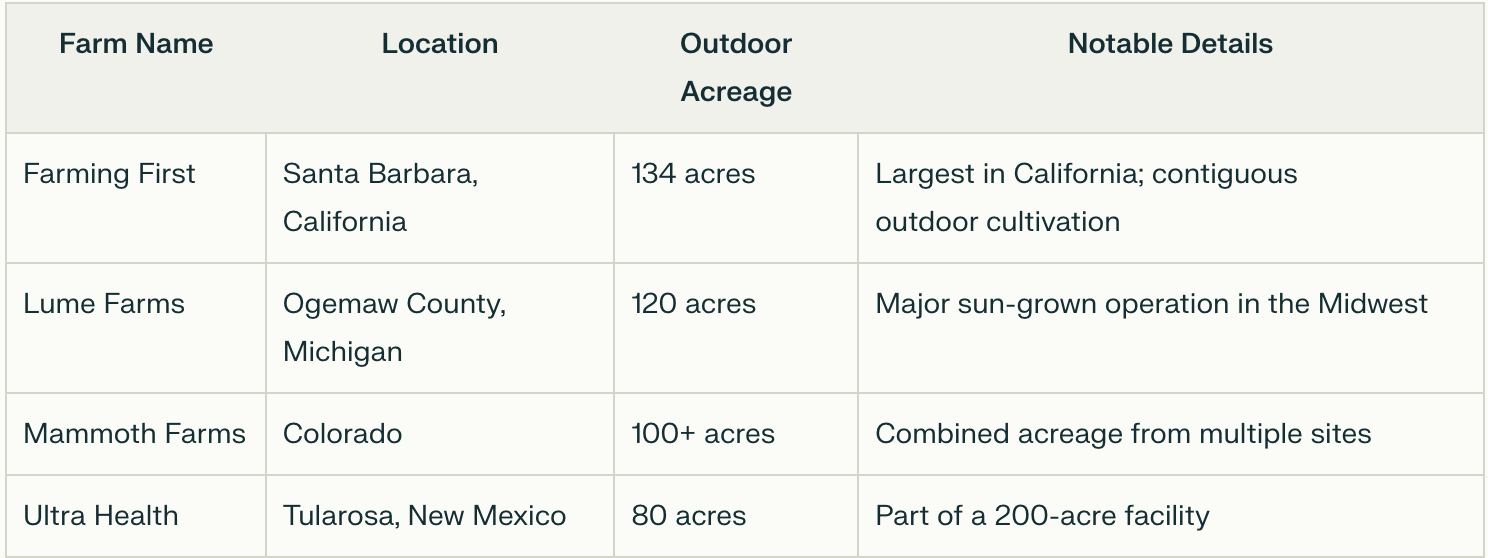

To put the size of the operation in perspective, we compiled a list of the largest legal outdoor cannabis farms. A lot of companies employ a mix of indoor, greenhouse, and outdoor cultivation, and we are not 100% sure that this list is exhaustive. Farming First is a private operation also located near Santa Barbara, with 134 acres licensed but with a publicly unknown area actually planted.

Even if you compare LEEF’s 187 acres of outdoor cultivation to a mixed operation like Ultra Health’s 211 acres of combined greenhouse/indoor/outdoor canopy, thought to be the world’s largest legal cannabis cultivation site, it’s a pretty impressive undertaking.

Why Extracts?

Extracts form the basis of nearly half of California’s $4.2 billion legal cannabis market. Product segments like edibles and beverages are growing faster than traditional flower sales as consumers increasingly move away from smokable options. For LEEF, being on the cutting edge of industry trends, even in such a young industry as legal cannabis, is a good sign for continued growth.

LEEF’s wholesale business model allows it to focus on its extraction expertise while leaving room for its brand partners to market the end products. These partner relationships can also lead to multi-state expansion as the brands look to achieve quality and consistency throughout their sales network. As a result of this dynamic, LEEF recently announced a move into the lucrative New York legal cannabis market which is anticipated to reach $1.5 billion in sales in just its third full year.

LEEF’s Upside

LEEF has been generating about $30 million in annual revenue for the past three years and anticipates significant sales growth in the coming three years. The move to provide its own feedstock by putting the Salisbury Canyon Ranch into production should, in itself, tip the company toward profitability. However, LEEF isn’t relying solely on that angle to drive growth. New York is the first, but not likely the last, state targeted for expansion, and the company has been adamant that it can penetrate new markets with a fairly capital-light approach.

LEEF currently trades at a valuation of around $20 million, which is roughly half of the appraised value of its wholly owned ranch property alone. Stay tuned for ongoing developments as the company continues to build value through multiple channels. You’ll want to be involved when the investment community recognizes the disconnect.