The cycle of investment in tech startups generally follows certain patterns. The company begins with an inner circle and an idea, oftentimes funded by the founders initially. Angel investors or friends and family can help fund further R&D, and grants and partnerships are sometimes crucial in the early stages. Once a company is pretty sure the idea is workable, venture capitalists tend to get involved with a bet on the viability of the technology. Debt financing can also play a role.

Eventually these startups either go public to access larger pools of capital, angle for an acquisition by a company able to commercialize or fully develop the product, or in rare cases decide to stay private and work toward a launch that will handsomely reward the founders and early investors.

Aduro Clean Technologies Inc. (NASDAQ: ADUR) (CSE: ACT) (FSE: 9D5) has been treading this road for many years, steadily developing its Hydrochemolytic™ technology platform that has the potential to completely revolutionize how plastic waste is recycled. It’s a gargantuan opportunity for the little company with a market cap in the $160 million range. After years of making ends meet through founders’ investments and non-dilutive grant financing, the capital markets are starting to take notice of Aduro as it executes its commercialization plan.

The company went public in 2021 on the Canadian Securities Exchange, a junior platform that served its purpose at the time. That CSE listing still exists, but in November 2024 Aduro listed its stock on the Nasdaq exchange in a public offering with shares priced at $4.25/each. The stock closed last Friday at $5.54/share, an increase of 30% in just over three months.

Microcap investor Mariusz Skonieczny owns about 1% of Aduro Clean Technologies. Here he reviews the company in depth and discusses the opportunity that lies in front of both the corporation and its investors.

Once public, successful companies are often found and backed by retail investors. It’s usually a necessary step to build an active retail market for the stock before institutional investors feel comfortable enough to take a bite of the apple. This is where Aduro is right now in its development arc. Institutions are starting to take notice as the company is initiating construction of a commercial-scale pilot plant, expected to be completed later this year.

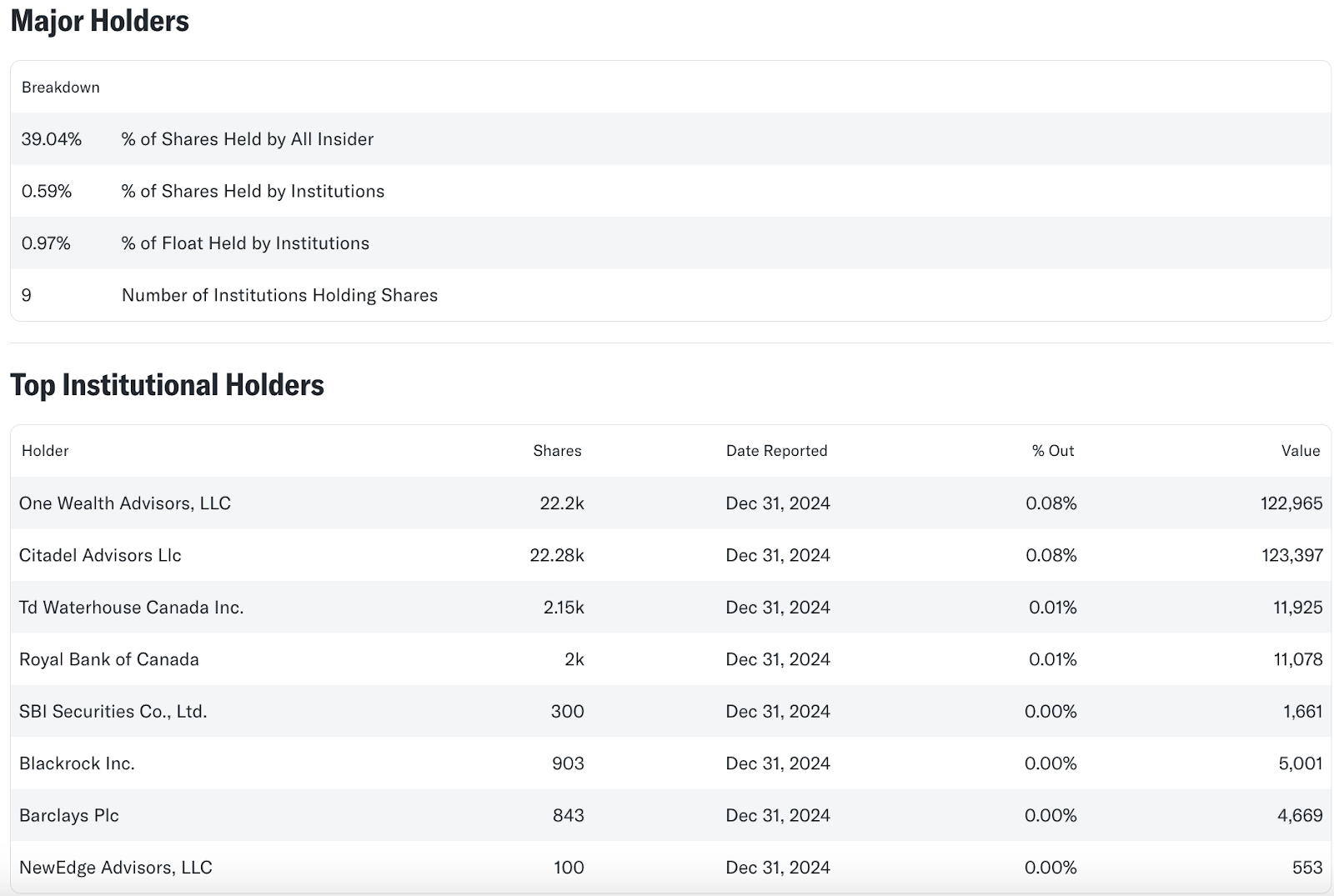

While insiders still control over 39% of Aduro’s stock, institutions have just recently started to accumulate shares and now account for about 1% of the company’s float.

Source: Yahoo! Finance

As you can see the numbers are not staggering, but there are now nine institutions that have purchased Aduro stock, and that is nine more than the company had prior to the Nasdaq listing. One Wealth Advisors and Citadel Advisors each hold over $120k in Aduro shares.

Institutions usually desire some level of liquidity and growth prior to investing to hedge against failure, and their purchases can often create a positive feedback loop with retail investors looking for signs that the company is on track. Aduro has partnerships and collaborations with at least three multinational corporations under its belt, including energy giants Shell and TotalEnergies, and is certainly tracking in a positive direction.

Investors should look for continued and increased institutional participation as the year goes on and commercialization approaches. Aduro’s closest peer, PureCycle Technologies (Nasdaq: PCT), recently attracted a $20 million investment from Stan Druckenmiller in the open market, which validates the dire need for investment opportunities in the plastic waste recycling landscape. It is notable that Druckenmiller has an impressive track record of finding early trends and investing in them ahead of most institutions. As such, he had a 30% average rate of return over the past thirty years.

PureCycle is slightly ahead of Aduro in terms of development timeline. The company has not reported significant revenue as of yet and is focused on recycling one type of plastic – polypropylene. Insiders now own less than 5% of the company and institutions (more than 300 of them) hold over 75% of shares. PCT is valued over $1.6 billion, reflecting the massive opportunity for companies that can develop more efficient ways to recycle plastic waste.

Meanwhile, Aduro is capable of recycling a much wider range of plastic types, including polypropylene, which means it has a significantly larger addressable market. Its market cap has more than doubled in the previous year, and institutions are only beginning to participate. Now is a good time to dig into Aduro and learn more about the company’s capabilities and potential before the cat is completely out of the bag.