New Domestic Development Offers Investment Opportunity

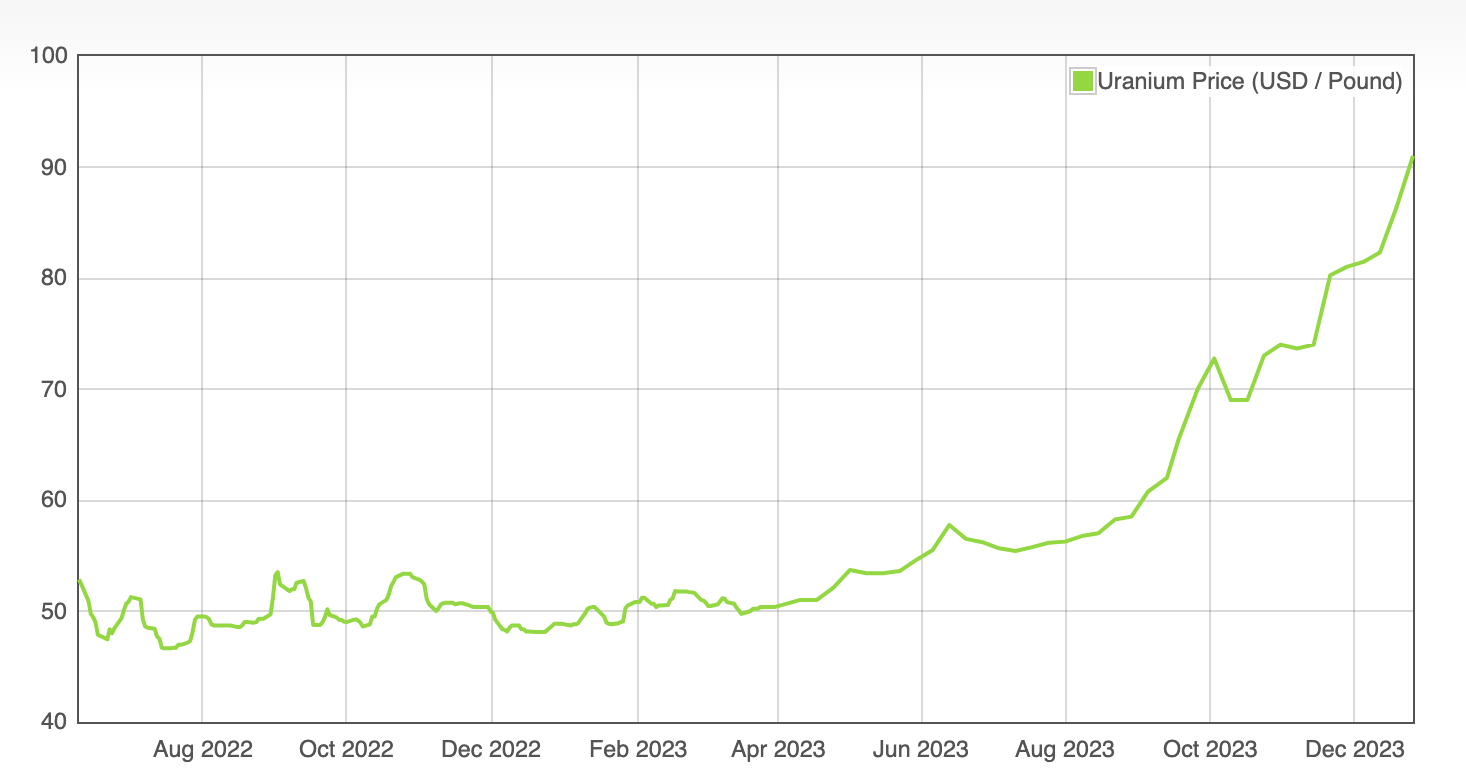

A combination of events across the globe has been pushing uranium prices to highs not seen since 2008. In 2011 the Fukushima disaster severely dampened the market for nuclear energy projects. In the intervening years, active miners cut production levels in response to the depressed market. Recently, however, nuclear projects have been increasing as the world looks for carbon-neutral energy sources. In just the past year, the price for uranium nearly doubled.

Uranium Price Per Pound – Source DailyMetalPrice.com

Cameco, one of the world’s largest producers, cut back its production forecast this year due to labor shortages and problems with equipment. The world’s largest uranium producer, by far, is Kazakhstan’s state-owned Kazatomprom. The company has been throttling production since 2018 but was having difficulty meeting even reduced levels of production this year due to shortages of key materials like sulfuric acid. Kazatomprom plans to increase output in 2025 due to positive changes in the market.

Meanwhile, over 20 countries just promised to triple nuclear energy capacity by 2050 at the United Nations’ climate meeting, citing the need to decrease emissions as the driving force behind the pledge. The growth in nuclear projects has already begun, with 170 new reactors either under construction or planned for the near future. The current supply/demand dynamic in the sector does not appear to be going away any time soon.

As a result, now is probably a very good time to look at new sources of uranium production as an investment opportunity. Investors can follow the lead of hedge funds which have been investing heavily in the sector, betting that uranium stocks will continue to rise with no apparent end to the supply/demand imbalance. In the United States and Canada, uranium exploration is being incentivized by the federal governments because domestic uranium supply is critical to national security. For exploration companies there has never been a better time to pour resources into discovering the next big uranium deposit.

Large Exploration Package in Canada

One explorer worth considering is Stallion Uranium Corp. (TSX.V: STUD) (OTCQB: STLNF) (FSE: HM40). Stallion Uranium has assembled one of the largest land packages in Canada’s Athabasca Basin, which contains the world’s richest uranium deposits. The company is particularly focused in the southwestern region of the basin, historically less explored than the more developed eastern area but home to several recent discoveries.

Stallion Uranium CEO Drew Zimmerman talks about why investors should be interested in Athabasca Basin exploration companies.

With a market cap in the $17 million range, Stallion is certainly a very small company but the net it has cast is outsized in comparison. The company’s land package in the Athabasca Basin covers 742,320 acres in total, with 692,647 acres concentrated in the western Basin. It’s a mix of wholly-owned and joint venture claims, strategically located adjacent to and along trend lines from major discoveries and development projects. The company believes its holdings in the western Basin comprise the largest contiguous exploration package in the area.

Stallion Uranium acquired its wholly-owned claims in January 2023 and commissioned a VTEMTM Plus electromagnetic (EM) and magnetic survey over the entirety of their holdings. The survey helped identify conductive corridors with the potential to hold significant uranium deposits. As a result, Stallion Uranium now has seven named projects identified for further exploration on these wholly-owned claims.

The Coffer Project is the first to advance with an exploration permit secured and a ground-based electromagnetic survey launched very recently. The Gunter Lake Project isn’t far behind, with an exploration permit recently granted and a ground survey to follow. In both cases, the ground survey will be combined with the airborne data to identify drilling targets. Expect other projects to follow the same process.

After closing the joint venture agreement with ATHA Energy Corp. in September, Stallion quickly launched an airborne electromagnetic survey over the entirety of the JV lands. These claims cover about 2,200 square kilometers. The joint venture calls for Stallion to spend $12 million on exploration of the claims in the next five years to earn a 70% interest in the holdings. Just over $3.3 million of that needs to be spent in this first year.

The Upshot

It was a very busy 2023 for the company. Two name changes, from Stallion Gold to Stallion Discoveries to Stallion Uranium, are signposts of the company’s progress. Stallion still has a couple of gold, antimony, and multi-mineral projects up its sleeve, in strategic areas of Idaho and Nevada. But the focus shifted at the beginning of the year to uranium with the acquisition of its initial claims, and the uranium program is now in overdrive with the addition of the joint venture claims.

Look for 2024 to be just as significant for Stallion Uranium as it further identifies and explores uranium targets. Drill results can greatly impact an explorer’s stock price. F3 Uranium Corp. began announcing excellent drill results from the JR zone of its PLN project in November 2022. Within two months the stock price rose from around $0.06 to the $0.30 range, which is about where it trades today.

Stallion’s Coffer Project lies 13 km east of F3’’s JR zone, and 3 km southeast of the Shea Creek Project, with over 85 million pounds of uranium resource indicated and inferred. The potential is certainly there for a major discovery, and Stallion’s team is putting its initial efforts into Coffer as its most promising project. But the company is set up to take many swings at a major discovery across its massive holdings. 2024 promises to be full of major developments for Stallion Uranium, and investors interested in the red-hot uranium market should be paying close attention.

CFN Media (“We” or “Us”) are not securities dealers or brokers, investment advisers or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company and are paid advertisers on behalf of Stallion Uranium Corp. (“Stallion” or the “Company”) If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Pursuant to our Agreement with Stallion, we have been compensated in cash by Stallion.

This document is for information purposes only and is solely for use by prospective investors in determining whether to seek additional information. This does not constitute an offer to sell or a solicitation of an offer to buy any securities. This document is not, and under no circumstances is it to be construed as, a prospectus, or advertisement, nor does it constitute an offer, invitation or inducement to purchase or acquire any securities of the Company. Offers are made only by the official offering documents and are subject to rejection or acceptance by the Company.

Potential investors must consult with their own advisors as to legal, tax, business, financial and related aspects of an investment in the Company.

The scientific and technical information contained in this presentation has been approved by [], a qualified person under Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

The information and statements contained in this document, including forward-looking information, have been provided to us by the Company. We have not independently verified any of information or statements in this document from any independent third party sources. We assume no responsibility or liability for the accuracy, truth, completeness or reasonableness of the information and statements contained in this document.

Forward-Looking Information

This document includes forward-looking information and forward-looking statements (collectively, “forward-looking information”) with respect to the Company. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases including, but not limited to, “expects”, “does not expect”, “is expected”, “anticipates”, “does not anticipate”, “plans”, “estimates”, “believes”, “does not believe” or “intends”, or stating that certain actions, events or results may, could, would, might or will be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking information”. This information represents predictions and actual events or results may differ materially.

Forward-looking information may relate to the Company’s future outlook and anticipated events or results and may include statements regarding the Company’s financial results, future financial position, expected growth of cash flows, business and marketing strategy, commodity prices, budgets, receipt of governmental approvals such as permit approvals, results of mineral exploration programs, anticipated timeline for completion of the Company’s projects and exploration programs, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends, and growth opportunities. Forward-looking information contained in this document is based on certain assumptions regarding expected growth, results of operations, performance, industry trends and growth opportunities of the Company.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking information involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. The foregoing factors are not intended to be exhaustive.

Furthermore, it cannot be assumed that all or any part of resources, whether classified as proven, probable, measured, indicated, inferred or otherwise, will ever be upgraded to a higher category. In accordance with Canadian rules, estimates of inferred mineral resources cannot form the basis of feasibility or other economic studies. Investors are cautioned not to assume that any part of the mineral resources are economically or legally mineable.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained in this document are made as of the date hereof and the Company and its directors, officers and employees disclaim any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, you should not place undue reliance on forward-looking information due to the inherent uncertainty therein.

All forward-looking information related to the Company is expressly qualified in its entirety by this cautionary statement. Forward-looking information and other information contained in this document concerning the mining industry is based on estimates prepared by management using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which management believes to be reasonable. While management is not aware of any misstatements regarding any industry data or comparable transactions presented in this document, industry data and comparable transactions are subject to change based on various factors. The Company has not independently verified any of this data from independent third party sources.

Certain of the “risk factors” that could cause actual results to differ materially from the Company’s forward-looking statements include, without limitation risks relating to the following: risks related to the receipt of all necessary third party approvals, including environmental approvals; changes in project parameters as plans continue to be refined; fluctuations in prices of commodities, including uranium; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of exploration, development or construction activities; health and safety risks; climate change risks; risks related to potential opposition from non-governmental organizations and public interest groups; changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in the United States; reliance on management and dependence on key personnel; competition in the mining industry; risks related to international operations; fluctuations in foreign currency exchange rates; substantial capital requirements and liquidity; uninsurable risks; litigation; risks related to and uncertainty associated with general economic conditions, actual results of current exploration activities, unanticipated reclamation expenses; and other factors beyond the control of the Company.

This document contains future-oriented financial information and financial outlook information (collectively, “FOFI”) as defined under Canadian securities laws, prepared by management about the Company’s reasonably estimated prospective results of operations, revenue, cash flows, and components thereof, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set forth in the above paragraphs. Readers are cautioned that FOFI are not guarantees of future performance, and should not be considered as such, since actual results may differ materially from those expressed in FOFI. The Company and its management believe that FOFI has been prepared on a reasonable basis, reflecting management’s best estimates and judgments. The Company disclaims any intention or obligation to update or revise any FOFI contained in this document, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the FOFI contained in this document should not be used for purposes other than for which it is disclosed herein.

Third Party Information

Statements made are as of the date or this document. Delivery of this document does not at any time create an implication that the information contained herein is accurate as of any date subsequent to today’s date. This document includes market and industry data which was obtained from various publicly available sources and other sources believed by the Company to be true. Although the Company believes it to be reliable, the Company has not independently verified any of the data from third-party sources referred to in this document or analyzed or verified the underlying reports relied upon or referred to by such sources, or ascertained the underlying assumptions relied upon by such sources. The Company does not make any representation as to the accuracy of such information.